Digital health incubator Rock Health has released it's 2012 year in review report, and it shows that venture capital investment in digital health is robust, if still tentative by some measures. Overall investment is up, but a large percentage of the numbers are accounted for by a few big deals and a few big investors.

Venture capitalists invested $1.4 billion in digital health in 2012, a 45 percent jump from 2011, when $968 million was invested, the report states. The total number of deals was 56 percent higher. These numbers are even more impressive, the report suggested, when compared to declining venture capital investment in traditional health segments like biotechnology and medical devices.

More than a fifth of 2012 funding, however, was from just five major deals: a $100 million round for healthcare shopping platform Castlight Health, $50 million dollar rounds for GoHealth, Care.com, and 23andMe, and a $45.5 million dollar round for Best Doctors. Four of those five can be broadly described as healthcare shopping platforms: GoHealth is a tool for comparing insurance costs, Care.com helps families find caregivers, and Best Doctors helps employees choose the right physician. So it's no surprise that Rock Health rated Health Consumer Engagement as the top category for digital health investment, with a total of $237 million invested.

The next category down, at $143 million, was personal health tools and tracking, followed by emergency medical records at $108 million and hospital administration at $78 million.

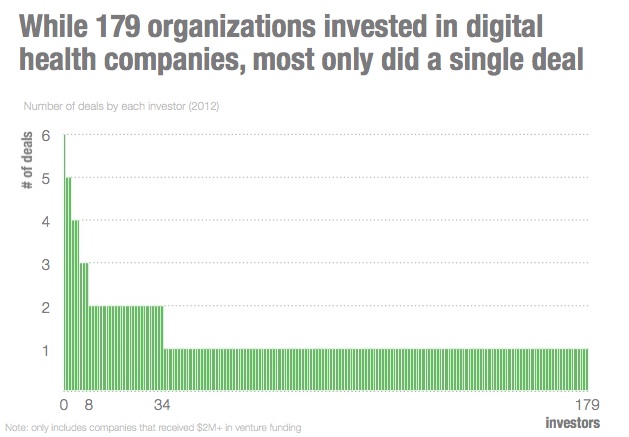

Perhaps the most striking number in the report, however, is that of the 179 digital health investors in 2012, 145 did only a single deal, and only eight did three or more. Within those eight, most major healthcare players are represented: telecommunications company Qualcomm Ventures, pharmaceutical company Merck (through the Merck Global Health Innovation Fund), insurer Blue Cross Blue Shield, and non-profit West Health. The other four are also familiar names to MobiHealthNews readers: Aberdare Ventures, NEA, Council Capital, and Khosla Ventures. Rock Health's new Angel Group hopes to see that another major player is well-represented among investors next year: physicians themselves.

Forbes writer David Shaywitz, in his analysis of the report, suggested the surprising number of one-time-only investors could have several explanations, but one is that investors are still tentative about digital health startups -- willing to try one out, but not willing to sink a substantial portion of their portfolio into the space.

The report also included some demographic statistics about digital health CEOs. Only 7 percent are women -- a surprising figure considering, for comparison, the high percentage of women in the medical field. On the other hand, only 5 percent of digital health CEOs are MDs, compared to 37 percent with Bachelor's degrees and 32 percent with MBAs.

The report was compiled by Rock Health Strategist in Residence Malay Gandhi and CEO Halle Tecco from information found in Capital IQ , the SEC, company websites, CrunchBase, the NVCA and the Rock Health's own funding database.