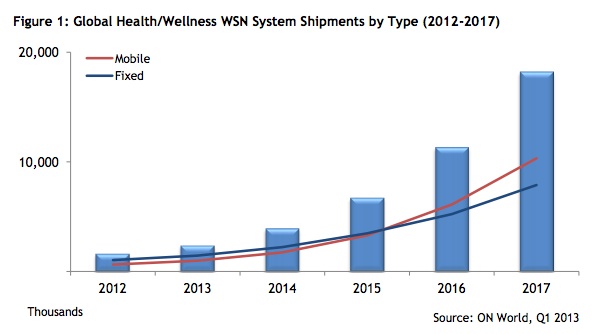

According to a new report by research firm ON World, 18.2 million health and wellness wireless sensor networks (WSNs) will be shipped worldwide in 2017, generating $16.3 billion in annual revenue. That's up from 1.7 million shipments and $4.9 billion in revenues in 2012.

According to a new report by research firm ON World, 18.2 million health and wellness wireless sensor networks (WSNs) will be shipped worldwide in 2017, generating $16.3 billion in annual revenue. That's up from 1.7 million shipments and $4.9 billion in revenues in 2012.

Between 2012 and 2017, the firm reported, health and wellness WSNs that are wearable, implantable, or otherwise mobile-enabled will increase by 75 percent per year (CAGR) and will make up 57 percent of all health and wellness WSNs in 2017.

Interestingly, ON World's numbers exclude sports and fitness trackers from the category of health and wellness wireless sensors. Other recent reports, like Juniper's report on the wearable market last year, have had their numbers significantly bolstered by including sports and fitness trackers. Mareca Hatler, research director at ON World, said the company will cover sports and fitness trackers in a pending report.

"We just saw there were really specific business models, and in terms of the volumes of shipments it would be best served if we covered it separately," she told MobiHealthNews.

ON World evaluated more than 100 health and wellness sensor products in compiling the report, not all of them wearable or consumer devices.

"WSN applications for health and wellness are expanding," the firm writes in its executive summary. "These include large scale hospital operational management systems, wearable/implantable sensors and vital signs monitors as well as wellness monitoring, mobile personal emergency response systems (PERS) and growing solutions for weight management, sleep monitoring and general wellness."

The company found that 53 percent of the companies they evaluated targeted self-management of chronic conditions. In 2017, ON World predicts, chronic condition management will make up 60 percent of WSN revenue, with 31 percent coming from heart disease and 24 percent coming from diabetes management.

The list of companies ON World evaluated, available on the firm's website, includes a number of companies familiar to MobiHealthNews readers: remote monitoring heavies like Philips and Qualcomm, the as-yet unlaunched home health scanner Scanadu, the now-defunct sleep tracker Zeo, and quirky startups like smart toothbrush-maker Beam Technologies and posture-coaching company LumoBack. Many of these companies were counted in the category of "general wellness," according to Hatler, a catch-all that includes devices like the Beam Brush, consumer vital sign monitors, sleep monitors, and, more than anything else, connected weight scales.

That general wellness category will expand 1,600 percent over the next five years, the report said, to make up 41 percent of shipments in 2017. As the general wellness category is primarily direct-to-consumer devices, this trend could suggest a growth of patient engagement and personal responsibility for help.

ON World also surveyed 300 early technology adopters and found that 30 percent were interested in web-connected health and wellness devices.