An estimated 330 million smartwatches will ship worldwide by 2018, up from less than 4 million in 2013, according to a recent projection from research firm ON World.

An estimated 330 million smartwatches will ship worldwide by 2018, up from less than 4 million in 2013, according to a recent projection from research firm ON World.

Fitness tracking is the most preferred feature on a smartwatch, ON World found in a survey of 1,000 online US consumers. The survey also found that 55 percent of respondents would prefer wearable technology on their wrists over any other part of their body. Finally, 38 percent of smartwatch adopters want to use their wearable technology for health applications.

ON World came to a similar conclusion a few months ago in its survey of 2,000 consumers on wearable devices. At the time, the poll found that almost 75 percent of Americans believed wearable technology would have a positive impact on health, sports, and fitness industries and that consumers most desired smartwatches followed by activity trackers, smart glasses, heart rate monitors, and smart clothing.

ON World's latest survey added that price is a significant factor in whether or not more consumers will adopt smartwatches. Forty percent of consumers are willing to pay $99 or more for a smartwatch that offered blood pressure, heart rate, and activity tracking sensors, but only 8 percent are willing to spend $299 or more.

Currently, no smartwatches on the market offer all of these features. While most activity trackers track steps and other activity with accelerometers, there are a few companies, including Basis and Withings, that also offer some kind of heart rate tracking. Last week, another company, Boston-based startup Whoop raised $6 million to build out its continuous heart rate-sensing wristworn activity tracker.

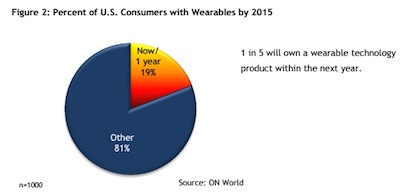

ON World released data from this same report just last week. ON World projected that in the next fives years an estimated 700 million wearable technology devices will ship worldwide, which will make for a $47.4 billion market. It also predicted that hardware sales will continue to dominate revenues for the next five years but monitoring services, apps, and subscriptions will have faster growth rates.