About 19 million wearable fitness devices are in use worldwide this year, according to a new report from Juniper Research, and that number is expected to nearly triple by 2018. Juniper predicts that market will continue to be dominated by designated fitness devices, but that smartwatches with fitness capabilities will gradually begin to eat away at the market as time goes on.

About 19 million wearable fitness devices are in use worldwide this year, according to a new report from Juniper Research, and that number is expected to nearly triple by 2018. Juniper predicts that market will continue to be dominated by designated fitness devices, but that smartwatches with fitness capabilities will gradually begin to eat away at the market as time goes on.

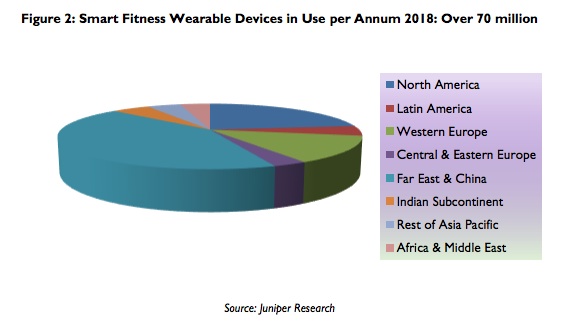

Most of those devices will be in use in the far east and China, according to the report, with North America and Western Europe falling in second and third.

"Fitness has been the first consumer segment to have a large range of devices available, thanks to increasingly cheap motion sensors, such as accelerometers," the firm writes in a whitepaper. "Smart wearable fitness devices have been around in some form or another since 2006, and so fitness is the segment in the wearables space closest to market maturity. However, the market itself is unlikely to experience the continued levels of growth that it has seen over the previous few years. The emergence of many smart watches in 2014 with comparable or better sensors, means that fitness devices will face increased competition in the coming years from these more complex devices, many of which are not marketed exclusively as fitness devices."

Juniper predicts that the fitness band and smartwatch markets will converge from both directions, with fitness bands taking on some smartwatch features, like call notifications, even as smartwatches like Apple Watch launch with activity tracking functionality and a marketing focus on fitness. At that point, fitness bands will have to compete on aesthetics, advanced functionality, or price point (Juniper points out the $13 Xiaomi fitness band as an example).

Another problem Juniper identifies is that fitness bands will have to deal with is the engagement pain point -- that, according to Endeavor Partners, a third of consumers who own a wearable device stopped using it within six months, and half of wearable device owners no longer use their device. Endeavor confirmed those results in a larger follow-up study.

"Given current levels of abandonment of fitness devices (currently estimated to be around 30 percent after six months’ usage), the market needs to find ways to make these devices appealing and relevant to consumers to develop usage and maintain interest," Juniper wrote.

The research firm also predicts that the next four years will see healthcare-focused wearables, such as those monitoring ECG to those tracking blood glucose, making a more significant market impact as regulatory challenges are overcome. Finally, in the report, Juniper weighs in on the emerging conflict between Fitbit and Apple.

"Fitbit will remain the leading player for fitness tracking, although their decision not to integrate with Apple Health may harm their market share in the short term," the firm wrote in a press release.