Lumity, a data-driven benefits management company, has raised $14 million. Social+Capital Partnership led the round, with additional contributions from True Ventures and Rock Health. This is the first round of funding for the company, which was founded in 2013.

Lumity, a data-driven benefits management company, has raised $14 million. Social+Capital Partnership led the round, with additional contributions from True Ventures and Rock Health. This is the first round of funding for the company, which was founded in 2013.

"With Social + Capital Partnership's funding we're excited to continue expanding our mission to help employers finally create health plans that make sense for their business, and most importantly, their employees," Tariq Hilaly, Lumity's co-founder and CEO, said in a statement. "[American small businesses are] in the middle of a perfect storm. They're getting hit hardest with rising health insurance premiums, with many employees now paying up to 40 percent of the cost of their healthcare. On top of that, the confusing array of plan choices lead many to over- or under-insure relative to their needs, collectively costing them over $40 billion every year. Lumity makes these complex decisions easy and saves employers and employees 20 to 30 percent -- without compromising benefits."

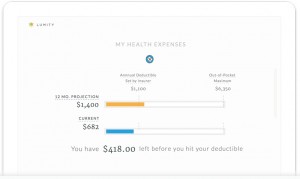

Lumity's service is targeted at businesses with 500 employees or fewer, which he says make up 99 percent of American businesses. He believes this group is generally overpaying for healthcare benefits because their companies can't afford the sophisticated data analytics to determine just which benefits each employee actually needs and will use.

"Lumity is leveling the playing field for small and medium-sized businesses," he writes in a blog post. "As a next-generation broker, we’re using powerful data technology and proprietary machine-learning algorithms to provide the kinds of tools, insights and customized benefits recommendations previously accessible and affordable only for large companies."

Lumity offers its software for free, but takes a broker's fee. The company also makes a point of having real human contact points for customers, rather than just relying on the technology to broker services.

The startup plays in a similar space to Silicon Valley darling Zenefits, an HR management startup now valued at $4.5 billion. Hilaly told Forbes that Lumity differs from Zenefits in a few ways, serving larger customers and also providing more proactive services that warn users "weeks in advance whether their company’s rates are likely to increase or decrease with their next contract."