Investment in digital health for the first half of 2016 has reached $3.9 billion, breaking funding records and showing a robust market that is expected to continue growing, according to a midyear report by digital health network and accelerator StartUp Health.

Investment in digital health for the first half of 2016 has reached $3.9 billion, breaking funding records and showing a robust market that is expected to continue growing, according to a midyear report by digital health network and accelerator StartUp Health.

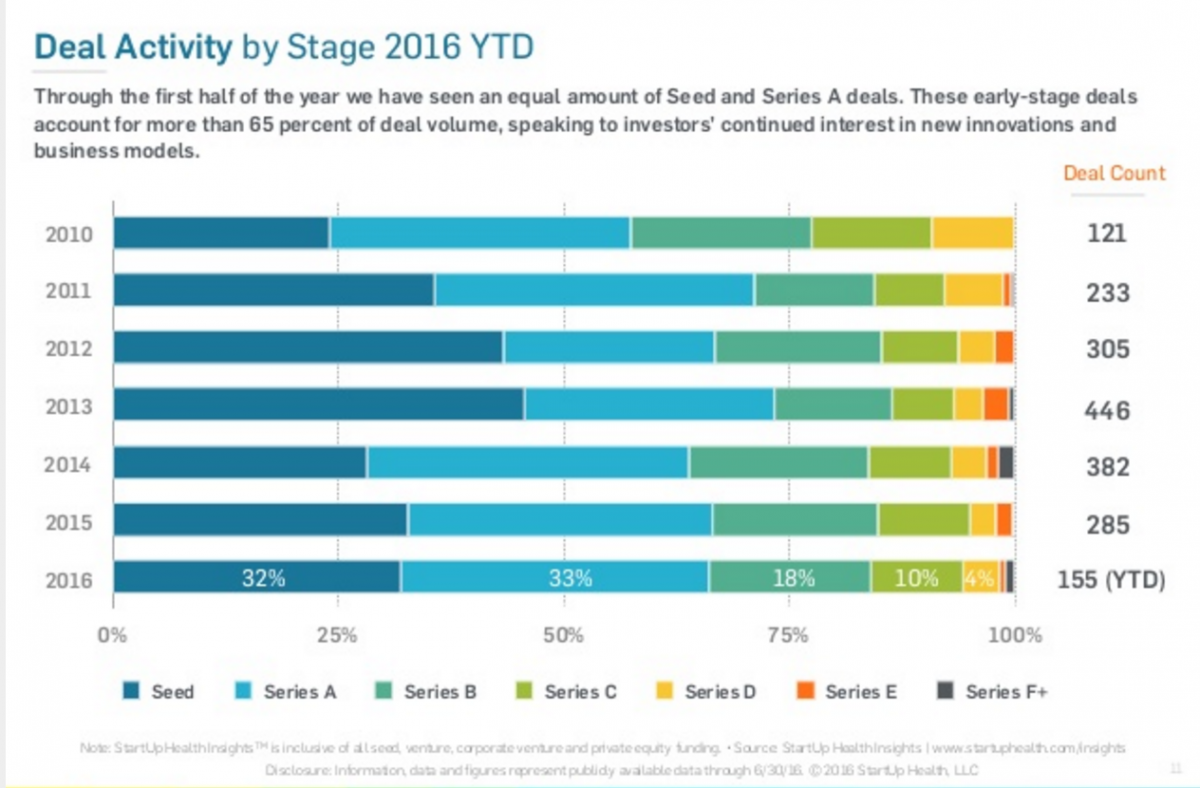

The report found the first half of 2016 to post the largest mid-year total on record for the industry, besting both last year's $2.9 billion at mid-year last year and $3.5 billion in 2014 -- the previous record. Early-stage innovation made up more than 65 percent of deal volume in the first half, with the bulk of money going to Series A rounds.

According to StartUp Health, Patient and consumer experience is the most active market thus far, with $958 million invested in this sector, followed by wellness at $854 million, personalized health at $524 million, big data/analytics at $406 million and workflow at $328 million. Research and population health are at the bottom of the company's list, with $65 million and $55 million, respectively.

More than 7,600 startups around the world are working on digital health innovations, according to StartUp Health's database. Thus far, three of the top 10 deals this year focus on tech-centered insurance, with New York-based insurance company Oscar bringing in $400 million in investments. (Although Chinese patient scheduling app, Ping An Good Doctor, was the largest deal at half a billion dollars, it was not included in the overall numbers of the report).

While there are more investors and more money, fewer deals were inked compared to previous years. The year 2015 saw 285 deals; by contrast 2014 had 382, and 2013 had 446. So far, the first half of 2016 had 155.

In smaller deals – under $10 million – a wide swath of the industry is represented, with startups primarily focused on medical devices, mobile apps, nutrition, wellness, big data and telemedicine evenly represented. The report noted an uptick in genome-sequencing companies like St. Louis-based Pierian Dx and personalized cancer treatment company Perthera.

The top two most active investors for the first half of the year are Menlo Park, California-based Khosla Ventures, and General Electric, which are both already close to their 2015 deal count. Based on number of deals so far this year, StartUp Health, the author of the report, is the top third venture investor, surpassing its 2015 deal count already.

In spite of the overall growth in the industry, few companies have found success in the public market. Looking back on digital health IPOs of 2015, the report listed only Evolent, the Arlington, Virginia-based population health MSO, as rising to meet their initial offering price, with five others, including Teladoc and Fitbit, falling short.

As far as where the growth is happening, the preeminent technology hubs of the San Francisco Bay area and New York City held strong as the hotbeds for digital health funding, trailed by San Diego, Boston and Chicago, respectively. Worldwide, India, China and Israel are beginning to foster more digital health innovation.