Physicians are up to their ears in information, eager for new, technologically advanced solutions, and struggling to keep up with healthcare reform. At least, that’s the sense researchers from the Decision Resource Group got from a recent survey of doctors.

Physicians are up to their ears in information, eager for new, technologically advanced solutions, and struggling to keep up with healthcare reform. At least, that’s the sense researchers from the Decision Resource Group got from a recent survey of doctors.

For the study, Taking the Pulse, the group surveyed 2,994 US physicians, finding that – in an era of a collective shift towards value rather than volume-based care – 43 percent of physicians say their organization is struggling to understand and meet goals, value and quality. And analysts think this could provide an oportunity for another group: pharma.

“This comes directly from our hypothesis around the ACA and the current healthcare landscape,” Kelly Pinola, digital healthcare analyst for the Decision Resource Group told MobiHealthNews “They've really been struggling, and when we think of creating overall experience for physicians, we are thinking about which ways we can support them. Pharma could really start integrating into EHRs."

Pinola said 53 percent of doctors surveyed reported having difficulty managing the sheer volume of information from multiple data streams, from patient-generated health data from devices to population and genomic data. What doctors need, she said, is to have more support in their workflow in the form of integration from pharmaceutical companies.

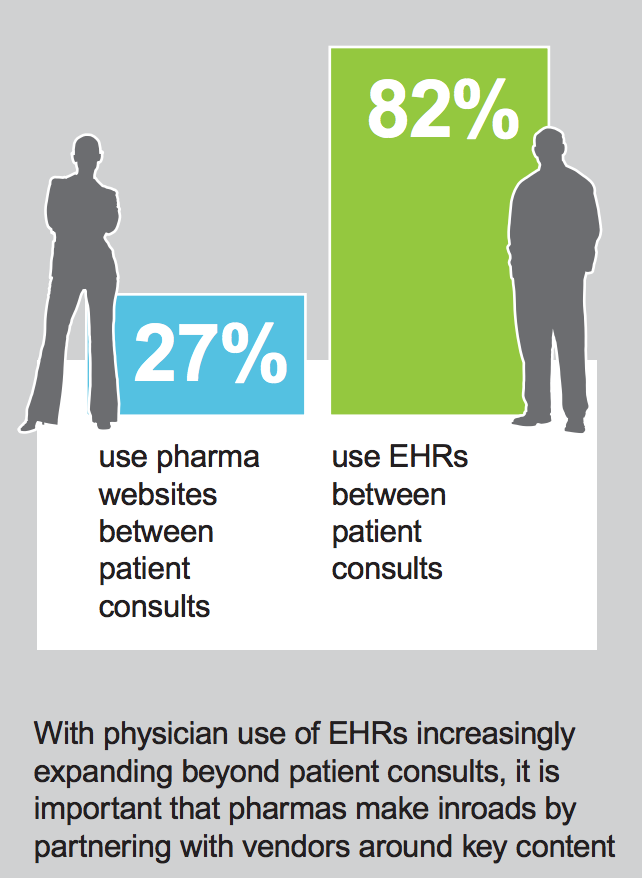

Between patient visits, 82 percent of the physicians surveyed use EHRs, but only 27 percent use pharmaceutical websites, showing the increasing preference to have the workstream integrated in one place. But few pharmaceutical companies have partnerships with EHR vendors, analysts from the Decision Resource Group said.

“This is kind of the next space where pharma needs to work itself into a new workstream,” Matthew Arnold, principal analyst at Decision Resource Group told MobiHealthNews. “How this is done is yet to be determined.”

Doctors want sponsored content from pharmaceutical companies, the survey found, with 85 percent of respondents reporting they would like access to information through online journals or websites for healthcare professionals.

It would be especially helpful during telemedicine situations, the survey found. While the 13 percent of physicians who conduct virtual visits spend more time going to pharmaceutical websites than those who don’t use telemedicine, they still don’t use those websites to support clinical decisions, highlighting a missed opportunity for pharmaceutical companies to make inroads by partnering with vendors around key content.

“Only a small percentage of physicians are actually using virtual visits, but when they do, they are using them to make big decisions,” Pinola said. “We saw 47 percent of these doctors using this time to prescribe or switch a medication during virtual visits, which is a really interesting trend.”

The analysts said they would recommend pharmaceutical companies provide physicans with content they can disseminate to their patients – educational material, coupons, supportive services, anything that could better integrate the medication aspect into the EHR.

"There isn't one simple solution to offer these resources to doctors, but it is something they should start planning," said Arnold. "The problem is, a lot of the larger enterprise vendors have had real difficulty partnering with pharma."