A recent report from PricewaterhouseCoopers, Customer Experience in Healthcare: The Moment of Truth, sketches out the rise of consumer health, and, of course, mobile is increasingly a key channel that providers need to get right.

A recent report from PricewaterhouseCoopers, Customer Experience in Healthcare: The Moment of Truth, sketches out the rise of consumer health, and, of course, mobile is increasingly a key channel that providers need to get right.

PwC points to five "forces" that are pushing providers in the healthcare industry to revamp their customer experience strategies: Increased cost sharing (including high-deductible health plans), the push for value by healthcare purchasers (including the rise of provider and facility ratings sites), the heightened desire for "on-demand" healthcare, increased access to personal healthcare information (PHI), and the newly insured thanks to health reform. PwC points to mobile health services as key to the increasing desire for on-demand healthcare, which is also being driven by an uptick in the percentage of patients who visit retail clinics (about 25 percent, according to PwC).

PwC also included a helpful industry comparison chart that provides examples of customer experiences in other industries and a comment about the closest parallel for the healthcare experience. For example, in banking consumers have mobile applications that allow payment, fund transfers and deposits, while in healthcare app increasingly give patients access to lab and exam information, physician contacts, claims, health and wellness support, according to PwC. The consulting firm also noted that while the airline industry offers mobile boarding passes and text and email alerts for flight delays, some emergency rooms and provider clinics now post wait times online and use appointment reminders via text.

Based on MobiHealthNews' own research into available apps for iPhone users, both of these comparisons and health app summaries ring true.

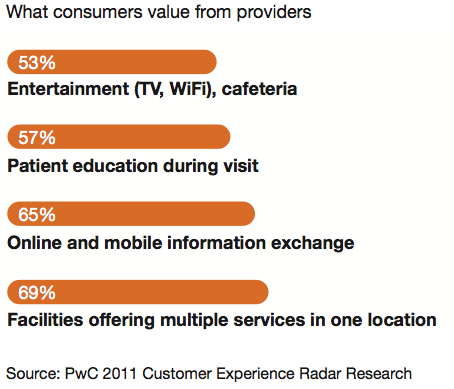

Based on PwC's surveys, about 65 percent of patients "value" online and mobile exchange of personal health information. Also, "young and urban respondents especially value electronic explanation of benefits and mobile wellness tips," according to the research firm.

PwC did note substantial generational differences when it comes to digital channels:

"In a recent HRI survey, 42 percent of consumers aged 18-24 said they seek primary health services in non-traditional channels (e.g. retail clinics, phone, web) versus 15 percent for people over 55. Nearly 90 percent of 18- to 24-year-olds said they would engage in health activities through social media.13 When age is combined with geography, the young and urban respondents value convenience three times more than the rest of the population. Other consumer segments value provider reputation the most," PwC wrote.