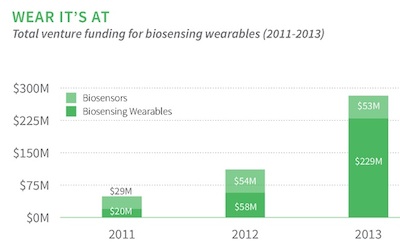

Venture funding for biosensing wearables, reached $282 million in 2013, five times what it was in 2011, according to a recent report and webinar from Rock Health. The report also points out that in that same period of time, funding for digital health as a whole doubled.

Venture funding for biosensing wearables, reached $282 million in 2013, five times what it was in 2011, according to a recent report and webinar from Rock Health. The report also points out that in that same period of time, funding for digital health as a whole doubled.

Although Jawbone has raised a significant amount of money, Rock Health does not include the company in its funding report because the funds could be used for Jawbone's other products. The report looks at close to 100 products.

Rock Health identified five active investors in the biosensing wearables space: Norwest Venture Partners, Founders Fund, Khosla Ventures, Qualcomm Ventures, and Felicis Ventures.

One reason the biosensing wearables space is growing so fast, Rock Health said, is that the price of popular sensors is dropping quickly. For example, the MEMS accelerometer, which is in most smartphones and activity trackers, has dropped from $2 in 2008 to $0.50 in 2013. The standard rate of decrease for consumer electronics component prices is 3 percent per quarter, but the price of sensors in digital health wearables is dropping faster.

Another reason for the quick growth of this area is, because of the rise of value-based healthcare, health plans that have already established incentive-based programs for members "are leaning on these types of wearable devices as sources of truth", Rock Health Managing Director Malay Gandhi said. He also added that Fitbit CEO James Park recently said that B2B is the fastest growing aspect of Fitbit's business.

"We know there's been a big push to move these devices into the healthcare system, taking advantage of the fact that the incentives have been realigned toward preventive healthcare," Gandhi said during the webinar.

Still, a big downfall of these biosensing devices that Rock Health identified in the report is that consumers aren't engaged with the products over a long period of time. An Endeavour Partners survey of 500 consumers in the United States found that a third of consumers who own a wearable device stopped using it within six months. Additionally, more than half of consumers who own one no longer use it.

This lack of engagement might be because of the "generic marketing language" that the Rock Health team found when surveying the top devices in stores.

"We were flooded with Jawbones, Fuelbands and Fitbits -- that's really what's on the shelves today," Gandhi said. "And you get into the marketing copy and you read it. Things like Jawbone say 'It celebrates milestones and challenges you to make each day better', and our big question is, what does that mean to an average person? We don't think an average consumer walks away from that saying 'I know how this device makes my life better'. We think this is a big challenge for those folks making these devices. That they pursued mass market type advertising, very aspirational marketing, instead of working to identify specific and narrow use cases."

Gandhi continues that for a device to reach a large market, it has to balance the line between being a general purpose device and offering a special purpose to the user. In these cases, unlike for biosensing wearables right now, users will stay engaged with the product. One example of a device that does this well is a smartphone because it has a core functionality, but users can add apps to it to make it better meet their needs.