A new survey of healthcare leaders, conducted by The Economist, belies a lack of consensus on both the benefits of mobile health and the barriers to implementation. The report highlights a widespread support for mobile health technologies, but also shows ongoing doubts about patient adoption and viable business models.

A new survey of healthcare leaders, conducted by The Economist, belies a lack of consensus on both the benefits of mobile health and the barriers to implementation. The report highlights a widespread support for mobile health technologies, but also shows ongoing doubts about patient adoption and viable business models.

The Economist spoke to 144 healthcare leaders in the public and private spheres working in the fields of pharma, biotech and medical devices in June 2014.

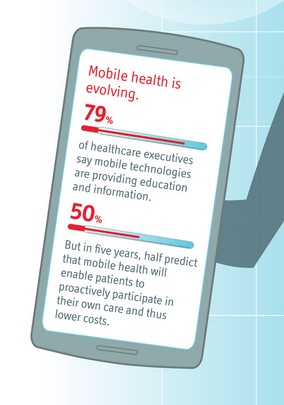

Seventy-nine respondents over all said the main role of mobile health right now is providing education and information, a big jump from the next most popular answer. Thirty-six percent saw improving the quality of communication between doctors and patients as the main role, and just 19 percent said it was "improving personal awareness through self-monitoring".

But, when asked to look five years into the future, most respondents saw that primary role shifting. Fifty percent said it would be “enabling patients to participate proactively in their care,” 50 percent said it would be to cut down the cost of healthcare delivery, and 29 percent said improving awareness through self-monitoring. Only 11 percent thought education and information would continue to be mobile health's primary role.

Sixty-two percent of public sector and 65 percent of private sector leaders said a top benefit of mobile health would be improved health outcomes, stemming from improved patient access to medical information (respondents were allowed to pick three benefits). Just slightly fewer respondents, 63 percent of public sector and 62 percent of private sector leaders, said patients would make better health decisions due to self-tracking. Trailing in third place was the assertion that operational stresses on healthcare organizations would decrease -- a viewpoint shared by just 35 percent in the public sector and 38 percent in the private sector.

Survey respondents also saw a variety of concerns about barriers to implement mobile technology as well as possible consequences once mobile health takes hold. Fifty-four percent worried that people will find it hard to use mobile technology, and 49 percent worried about the security of personal data. (Interestingly, in North America that number jumped up to 65 percent).

After privacy concerns, the biggest barrier according to 44 percent of respondents, was the "institutional bias and conservatism within the healthcare establishment", i.e. the inherent risk-averse nature of healthcare. Only 19 percent of respondents put regulatory barriers to innovation in their top three.

The biggest concern about mobile health on the consumer level, cited by 52 percent of respondents, was that people would misinterpret their data and make bad decisions.

Another fear among some respondents was that health apps would fail to make an impact or make money. Ten percent of respondents, and 19 percent of US respondents, believe that mobile health has "no promising revenue model," the report says. The top two business models as rated by survey respondents were selling health services (41 percent) and selling subscriptions to premium educational and advice content (38 percent).

The report pointed to pharma as an area where a large number of apps (Bayer, Merck, and Novartis have each created more than 100) have yielded a small number of downloads (less than one million for the most popular apps, according to a research2guidance study last year). This illustrates a gap that still exists between mobile health's potential and its actual impact, the report suggests.