Investment trends in digital health companies point to increasing evidence of a maturing space, according to StartUp Health's Midyear Report. StartUp's figures show that overall investment tracks with the first half of 2014, but a larger percentage of deals is focused on later-stage companies.

So far this year, StartUp Health has reported 226 deals and a total of $2.8 billion in funding, compared to 551 deals and $6.9 billion in funding for the whole of 2014. StartUp Health uses a broad definition of digital health, which is why their funding numbers always track higher than MobiHealthNews' figures (we have funding to date at a little over a billion) and Rock Health's, which have yet to come out.

For instance, StartUp Health's top three deals were a $500 million raise for Zenefits, an employee benefits manager, a $145 million raise for Oscar, a health insurer, and a $100 million raise for NantBioScience, a life sciences company. Companies that fit more squarely into digital health's scope can be found further down the list in a three-way tie for seventh biggest deal: $50 million rounds for DoctorOnDemand, MDLive, and PillPack. These deals, along with Teladoc's $157 million IPO this morning, point to video visits companies as a major digital health trend in 2015.

StartUp Health identified the top subcategory of the quarter as wellness and benefits, with $647 million raised, but the huge round raised by Zenefits likely skewed that number. The second biggest subcategory was patient and consumer experience with $428 million spread out over 46 deals, on track to surpass last year, when that group brought in $800 million over 80 deals. Big data and analytics, last year's top subcategory, came in third this half with 23 deals totaling $333 million in funding.

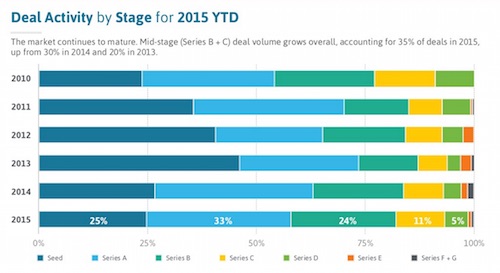

Broken down by company stage, on a percentage-basis this quarter's deals tracked with last year and with 2010, but stood in contrast to 2011 through 2013, years when seed funding boomed and late stage investment tapered off. This half, 25 percent of the deals StartUp tracked were seed funding, 33 percent were series A, 24 percent were series B, 11 percent were series C, and 5 percent were series D. Both late and mid-stage deals had a median amount around $15 million, while the median amount for early stage deals was $2.4 million.

Khosla Ventures was the biggest investor of the year so far by number of deals, investing in almost as many companies in the first half of 2015 (nine companies) as it did in the whole of 2014 (10 companies). Both GE Ventures and Venrock have already invested in more companies than they did in 2014, with eight deals each to their name this year compared to seven deals each last year. Qualcomm, which led in 2014 with 12 deals, has only made five investments so far in 2015.

Finally StartUp Health tracked 19 M&A deals this half, and one of those was Under Armour's acquisition of Gritness, which we reported this morning. By their reckoning, nine of those acquisitions were made by big companies, seven were made by startups, and three were made by funds. MobiHealthNews tracked 15 M&A deals during the first half of the year.