Digital physical therapy, telehealth, and patient engagement platform Physitrack will seek public listing on alternative stock exchange Nasdaq First North during the first quarter of 2018, cofounder and CEO Henrik Molin told MobiHealthNews this week. The company has not yet set the terms of this IPO, but said in a statement that it plans to use the offering to fund further expansion into new regions and accelerate its research and development efforts.

Digital physical therapy, telehealth, and patient engagement platform Physitrack will seek public listing on alternative stock exchange Nasdaq First North during the first quarter of 2018, cofounder and CEO Henrik Molin told MobiHealthNews this week. The company has not yet set the terms of this IPO, but said in a statement that it plans to use the offering to fund further expansion into new regions and accelerate its research and development efforts.

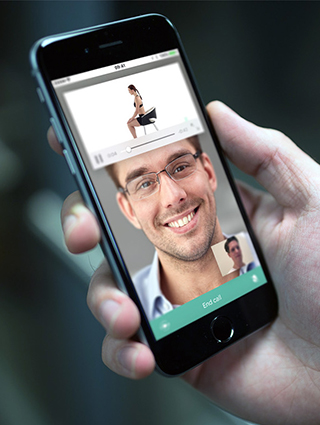

Founded in 2012, Physitrack’s virtual platform offers an alternative to the traditional paper-based exercise regimens supplied to patients preparing for or recovering from surgery. The platform’s remote monitoring and compliance tracking makes both parties more accountable, and provides patients access to educational physical therapy content. The service is marketed to healthcare providers, is employed in 102 countries, and recently passed 1.2 million total patients.

However, the company has followed a different trajectory than many in the digital health space. Because of cofounder and CTO Nathan Skwortsow’s prior successful exits and healthy initial funding from friends and family, Molin explained, Physitrack was largely able to avoid the pressures and demands of venture capital.

“From the start, we never really needed to look for external capital for the business,” Molin told MobiHealthNews. “That became just core thing for us, not having to access traditional venture capital. It enabled us to be a little more inward-focused with the business, to just really build something that we were excited about and that we though we could excite other people about. We didn’t really have to care about providing metrics for external parties.”

The pressures of venture capital are not just the norm, he continued, but all too often become a roadblock for ideas that need a little more time to germinate.

“A lot of people are taking funding; I think some $14 billion were invested into this space in the last couple of years," he said. "[We’ve seen] some amazing solutions, some very smart people, but monetization has been very difficult, and the pressure to move faster toward monetization has been quite overwhelming. So I think in a digital health business it’s optimal to be a little bit less VC-constrained … That sets us aside from a lot of digital health plays.”

In total, Physitrack has received just under $3.5 million in outside funding with its last round concluding in 2015. This amount was just enough for the company to reposition itself as a cashflow-positive company with regular growth, Molin said.

However, the company’s big break came when Physitrack — along with others such as drchrono — was tapped to participate in Apple’s Mobility Partner Program, which was largely kept under wraps until earlier this year.

“It’s a way for Apple to help a number of companies who are interested in having better solutions for iOS,” Molin said. “It was a very intense few months working closely with Apple on that project. It was the single most disruptive thing for this company, in a good way, because for us the reworked iOS app … absolutely exploded after that. We managed to find product market fit sometime before we did the Apple project, but when we nailed the UI and UX situation within the system, people just started loving Physitrack like nothing else, and that’s when we had our breakthrough.”

Since then, Molin said that his company has had its eyes set on an eventual public offering, which he feels can offer a distinct advantage when growing a young company.

"Just to be able to have that brand recognition as a stable, bigger player targeting enterprise, I saw that as being very favorable,” he said. “As a public company, even if it’s a small public company, I think you have a much better chance of closing business and growing business in the enterprise space than you would as a small, privately-seeded company that’s under the radar.”

According to a statement, Physitrack is collaborating with Capita Plc and other key service providers for legal, compliance, accounting, and corporate governance connected to the IPO, and is in the process of appointing Certified Advisors for the transaction.