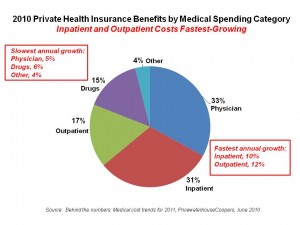

Medical costs will increase by 9% in 2011, a mere 0.5% less than 2010 cost growth. The fastest-growing components will be inpatient and outpatient costs, shown in the pie chart. 81% of premium costs are bound up in provider costs for hospitals and physicians — the two most significant factors of medical inflation.

Medical costs will increase by 9% in 2011, a mere 0.5% less than 2010 cost growth. The fastest-growing components will be inpatient and outpatient costs, shown in the pie chart. 81% of premium costs are bound up in provider costs for hospitals and physicians — the two most significant factors of medical inflation.

And Americans will bear even more medical costs, out-of-pocket (OOP), in 2011 in the form of greater coinsurance and deductibles.

Behind the numbers: Medical cost trends to 2011 looks into employers’ crystal balls on health benefits for 2011. PricewaterhouseCoopers’ Health Research Institute surveyed 700 U.S.-based companies, small through jumbo sized, to gauge their perspectives on health care costs and benefits program priorities for 2011. Interviews were conducted in the first quarter of 2010.

While there are many uncertainties surrounding employers and health benefits, a few certainties emerged from this survey:

Employers will use more coinsurance at the point of care, moving away from co-payments, which will result in employees paying more out-of-pocket to health providers.

Hospitals will get less out of Medicare, and will try to shift costs to (i.e., get higher payments out of) commercial insurance payers.

Providers will join together and consolidate for greater bargaining power vis-à-vis health plans.

PwC expects countervailing pressures on costs: increasing factors will be Medicare cost-shifting, providers consolidating, and health IT investments stimulated by ARRA HITECH incentives. Cost-deflators will be greater coinsurance for employees (which mean higher OOP costs for consumers), more generic drug utilization continuing to decrease pharmacy costs, and COBRA costs levelling off.

More coinsurance will be used across all categories of health services, most notably specialty drugs, brand name drugs, generics, ER, specialty care, and even primary care.

Behind the growing coinsurance and higher OOP phenomena, though, is an expectation among employers that they’ll add wellness and health management programs in 2011. Three-quarters of employers already offer wellness programs to eligible employees, and two-thirds offer disease management. The proportion of employers offering these programs increases by company size.

Health Populi’s Hot Points: There is evidence that with growing out-of-pocket costs, health consumers can make short-term ‘rational’ fiscal decisions like skipping recommended medical tests and visits to doctors to avoid co-payments and deductibles. These short-term fiscal ’smart’ decisions can lead to longer-term bad physical outcomes by postponing early diagnosis and treatment, resulting in more expensive, more invasive care and more complex medical conditions. Consumers’ self-rationing health care is often done irrationally. Greater coinsurance should be coupled with tools and useful, engaging information that helps people make sound health care decisions.

In an artfully-designed value-based health plan, employers and their benefit consultants should be mindful of this aspect of health consumer behavior. Employers surveyed by PwC recognize that their wellness and DM program investments haven’t generated a high return-on-investment. It’s crucial to connect-the-dots between the medical benefit design and peoples’ ‘real’ lives on a 24×7 basis. Think in terms of the micro-decisions that people make, from parking cars further from office entry doors to consuming healthier food offered up in company cafeterias. The disconnect isn’t just ironic — it’s self-defeating, and economically wasteful.