Portland, Oregon-based Cambia Health subsidiary HealthSparq, an online shopping platform for healthcare services, has acquired ClarusHealth Solutions, an online provider search tool, for an undisclosed amount. The acquisition triples HealthSparq's payor clients, bringing the number from 20 to 60 health plans, a total of 60 million consumer users.

Portland, Oregon-based Cambia Health subsidiary HealthSparq, an online shopping platform for healthcare services, has acquired ClarusHealth Solutions, an online provider search tool, for an undisclosed amount. The acquisition triples HealthSparq's payor clients, bringing the number from 20 to 60 health plans, a total of 60 million consumer users.

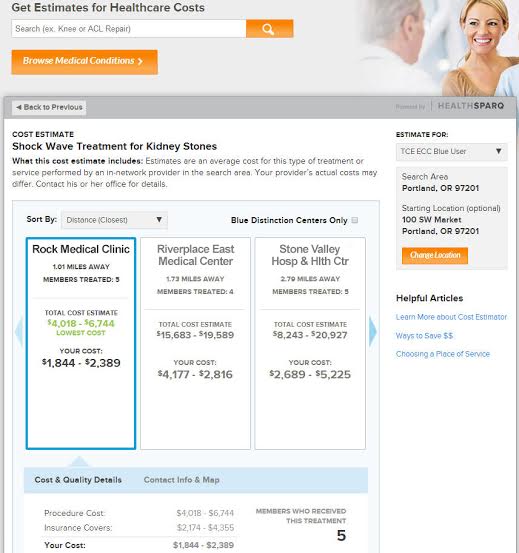

HealthSparq partners with small, regional health plans to offer the plan's members comparison shopping on an online platform. It uses the plan's historical data to give users an idea of the costs and time involved with different procedures, and the price and quality of different providers. A calculator provides users with out-of-pocket costs as well as overall costs. The company also offers tools for searching for providers and leaving feedback for other consumers.

The technology is mostly web-based, but HealthSparq uses responsive design to make the tools accessible on mobile devices as well. In addition, it opens its APIs to health plan partners, some of whom have built native mobile apps.

"From a strategic standpoint, we had a broad and integrated experience," Scott Decker, president of HealthSparq, told MobiHealthNews. "We’ve really tried to step back from the shopping experience. It's more than just cost data, it's integrating that data. ... We had this comprehensive suite. The folks at Clarus had focused more on search, and they had really been looking for a partner to build out the experience."

According to Decker, ClarusHealth, formerly known as PRISM Services Group, was owned by a single individual who was looking to sell. The acquisition will also double HealthSparq's workforce, to about 110 employees. This won't change HealthSparq's offering very much in the short term, Decker said, but it will allow the company to both scale more quickly, and invest more energy in research and development. Decker said he thinks working with health plans, as both HealthSparq and ClarusHealth have done, is an advantage for effective healthcare transparency.

"Our model is very much one of working with the health plans as opposed to going around," he said. "What we found is the partnership with the health plans provides access to data that we can do pretty sophisticated analytics on. I think that’s why we’re gaining traction so fast."

Last week brought news of UnitedHealthcare adding a cost comparison tool for its users, and Decker said he expects this trend to continue among major health plans.

"I think [the cost comparison space] is going to go through explosive growth in the next 24 months," he said. "Twelve months ago, it really didn’t exist. And now it seems that across the board every plan in the country is looking at this in some fashion. Thirty-six months out you’ll see a market characterized by this sort of becoming the norm, which will hopefully make [healthcare] a more real market."