Lexington, Massachusetts-based Imprivata confidentially filed a draft statement with the Securities and Exchange Commission (SEC) for an initial public offering this week. The draft filing marks the second confidential filing for a digital health company in the past few days -- healthcare costs transparency company Castlight Health filed for an IPO at a reported valuation of upwards of $2 billion at the end of last week.

Lexington, Massachusetts-based Imprivata confidentially filed a draft statement with the Securities and Exchange Commission (SEC) for an initial public offering this week. The draft filing marks the second confidential filing for a digital health company in the past few days -- healthcare costs transparency company Castlight Health filed for an IPO at a reported valuation of upwards of $2 billion at the end of last week.

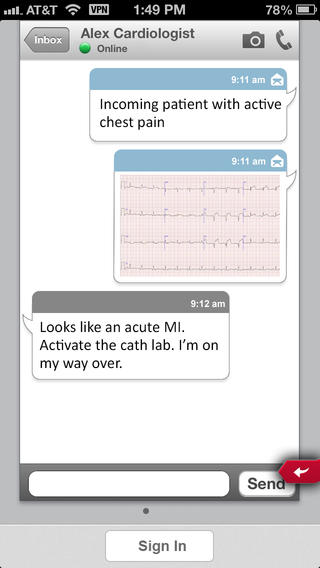

Imprivata's products include OneSign, a single sign-on, authentication system that includes biometric identification as well as virtual desktop roaming for clinical apps. Its other major offering is Cortext, a secure communications platform for clinicians to use when collaborating with their care team. At HIMSS last year, Imprivata launched a smartphone app called Cortext 2.0 for iPhone, Android, and other platforms via a web-based version. While healthcare is Imprivata's key area of focus, it also serves other industries, including banking, energy, and government.

Imprivata has raised about $50 million to date and its investors include Polaris Partners, Highland Capital Partners, General Catalyst, and SAP Ventures. Its last announced investment was a $15 million third round led by SAP Ventures back in 2008.

In May 2013 the company announced that its revenue for the first quarter of 2013 grew by more than 32 percent year-over-year. It added 47 new healthcare customers, which included about 1,000 hospitals and more than 2 million licensed users at the time. Imprivata said it had also added 42 new employees and contractors during the first quarter of 2013, increasing its global headcount to 237 at the time.

Confidential IPO filings are a relatively new trend made possible by the JOBS Act of 2012, which aimed in part to make it a bit easier for what the legislation refers to as "emerging growth companies" to go public. The confidential filing allows Imprivata to privately discuss the potential IPO with the SEC, but the draft documents will be made publicly viewable once the company formally files for an IPO. Imprivata could also opt-out from some Sarbanes-Oxley rules for a five-year period and could opt not to disclose some executive compensation details.