New York-based Everyday Health filed for an initial public offering that it expects will raise up to $115 million, according to SEC documents.

New York-based Everyday Health filed for an initial public offering that it expects will raise up to $115 million, according to SEC documents.

The joint book-running managers for the IPO are J.P. Morgan Securities, Credit Suisse Securities (USA), and Citigroup Global Markets.

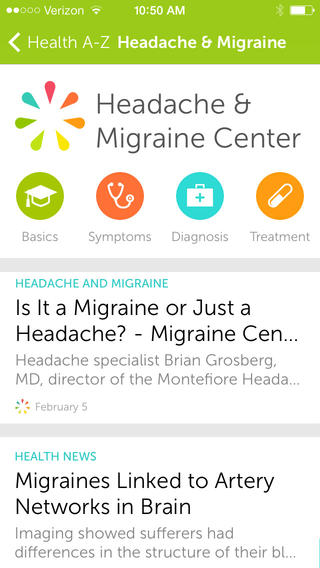

Everyday Health offers users an app and web tool to aggregate health information on a variety of topics, including nutrition, diabetes, fitness, digestive health, heart health and auto immune diseases. The company also offers free newsletters for those that want to get health and wellness information in their inbox.

Everyday Health initially filed for an IPO in January 2010, but withdrew the filing that November. The company cited "changed circumstances regarding security markets" as the reason for pulling back on its IPO plans in 2010.

Everyday Health has raised close to $90 million to date, according to SEC filings. The company's investors include BEV Capital, NeoCarta Ventures, Rho Capital Partners, Technology Crossover Ventures, and Scale Venture Partners. Former AOL CEO Steve Case's investment firm Revolution has also invested in Everyday Health.

This is at least the fourth company with digital health ties that has filed for an initial public offering this year. Big data company IMS Health, which launched a health app prescribing platform in December called AppScript, filed at the beginning of the year. In early February, price transparency tool maker Castlight Health filed for an IPO and is expected to seek a valuation upwards of $2 billion. A few days after, secure healthcare communication company Imprivata filed for an IPO confidentially.