New entrants in the healthcare space are poised to disrupt the system in the next few years, according to a new report from PricewaterhouseCoopers, which cites the number of upstart companies in other industries -- 24 -- on the latest Fortune 50 list.

New entrants in the healthcare space are poised to disrupt the system in the next few years, according to a new report from PricewaterhouseCoopers, which cites the number of upstart companies in other industries -- 24 -- on the latest Fortune 50 list.

"Technological advances, empowered consumers, disruptive new entrants, and rising demand by an aging population are ushering in a new era in healthcare," PwC writes in the report. "While many of those trends have been emerging for some time, never before have they been accompanied by a rapid shift in dollars, triggering major changes in behavior and fundamentally altering the business."

The report is partly based on a survey of 1,000 consumers conducted by Health Research Institute. The study found that, on top of the $2.8 trillion spent annually on healthcare, consumers were willing to spend $13.6 billion a year "on medical products such as health-related video games and ratings services".

HRI asked consumers how likely they were to use certain hypothetical mobile health tools. Fifty-five percent said they would use an app for teledermatology, and another 55 percent said they would check vital signs at home with a phone-connected device. Using a smartphone, 47 percent would check for an ear infection, 44 percent would do an EKG test, 42 percent would do urinalysis, and 39 percent would do a video visit with a clinician.

More broadly, 64 percent of consumers said they were "open to new, nontraditional forms of care" if the price was right, and another 18 percent were open to new forms of care at any price. Forty-three percent of consumers said they would prefer to shop for healthcare online.

"Care delivery, following the move from inpatient to outpatient services, will inch ever closer to the home via retail businesses, remote monitoring and mobile devices," the research firm predicts. "For incumbent health companies, the emergence of these popular technologies presents a central challenge: to partner or compete? Successful organizations will squeeze out administrative waste, improve the health of entire communities, reduce costly errors, better manage chronic conditions, understand consumer preferences or develop targeted therapies with proven advantages for a given patient group. Transparency in cost and quality will fuel these developments."

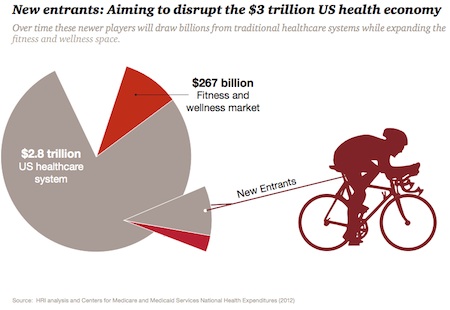

PwC's data still puts the "New Healthcare Economy" in its early stages. Ancillary fitness and wellness services of any kind are only about a $267 billion industry, compared to healthcare's $2.8 trillion. Within that, mobile apps are only about a $1.3 billion sector. But the firm believes the shift is already beginning.

"The lines are already blurred," they write. "Health systems are securing insurance licenses. A telephone giant advertises its role in treating sick children in India and the Philippines. And drugstores are pushing deeper into care delivery ... These innovators — some incumbents, some newcomers and some hybrids — are sketching out the contours of the New Health Economy."