IBM has finalized plans to acquire Merge Healthcare for $1 billion, in the hopes that assets from the medical imaging software company can teach IBM's cognitive computing unit Watson to "see" medical images.

IBM has finalized plans to acquire Merge Healthcare for $1 billion, in the hopes that assets from the medical imaging software company can teach IBM's cognitive computing unit Watson to "see" medical images.

“As Watson evolves, we are tackling more complex and meaningful problems by constantly evaluating bigger and more challenging data sets,” John Kelly, senior vice president, IBM Research and Solutions Portfolio, said in a statement. “Medical images are some of the most complicated data sets imaginable, and there is perhaps no more important area in which researchers can apply machine learning and cognitive computing. That’s the real promise of cognitive computing and its artificial intelligence components – helping to make us healthier and to improve the quality of our lives.”

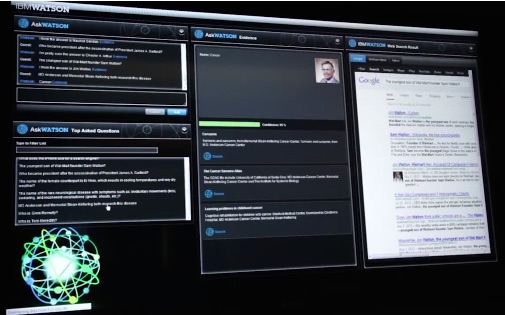

Right now, Watson can parse unstructured mathematical data and can employ natural language processing to read large data sets in written form. But IBM researchers estimate that medical images account for at least 90 percent of all medical data today, and images aren't currently something Watson can work with. Using Merge's software and datasets, Watson will be able to scan medical images, like X-rays, brain scans, or dermatological images, and compare them to a database of historical images, in order to detect anomalies or historical correlations.

IBM will also continue to support Merge as an independent business providing imaging software to healthcare providers. In fact, the 7,500-plus hospitals, health systems, pharma companies and CROs that Merge counts as its customers could provide a streamlined commercialization path for Watson Health.

"In short, as a result of this transaction, Merge products will only become better and you will benefit from continued innovation to support your medical imaging needs," Merge CEO Justin Dearborn said in an open letter to customers. "I want to assure you that you can continue to expect the same level of service that you have come to rely on from Merge. Importantly, IBM will continue to support the Merge platform, and will continue to honor all existing contracts and agreements."

This is the third healthcare acquisition for IBM, which announced the purchases of Phytel and Explorys when it officially spun off IBM Watson Health into its own business unit in April. Those two acquisitions were both big data analytics companies. Explorys was a Cleveland Clinic spin-off that uses cloud computing to detect patterns in diseases and treatments. Phytel developed cloud-based tools to enhance care coordination and outcomes. Terms were not disclosed for either deal.

Merge was founded in 1987 and IPO'd in 1998. Merge's shareholders will receive $7.13 per share in cash.

“As a proven leader in delivering healthcare solutions for over 20 years, Merge is a tremendous addition to the Watson Health platform. Healthcare will be one of IBM’s biggest growth areas over the next 10 years, which is why we are making a major investment to drive industry transformation and to facilitate a higher quality of care,” Kelly said. “Watson’s powerful cognitive and analytic capabilities, coupled with those from Merge and our other major strategic acquisitions, position IBM to partner with healthcare providers, research institutions, biomedical companies, insurers, and other organizations committed to changing the very nature of health and healthcare in the 21st century. Giving Watson ‘eyes’ on medical images unlocks entirely new possibilities for the industry.”

[youtube]https://www.youtube.com/watch?v=7h42b92I4bM[/youtube]