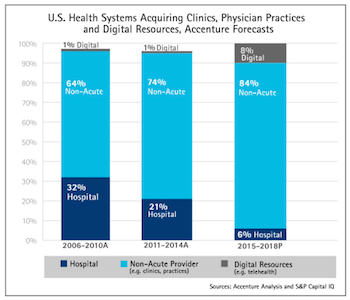

By 2018, 8 percent of health systems' acquisition volume will be made up of digital health startups, up from 1 percent in 2014, according to a report from Accenture, which made projections based on an analysis of 1,500 healthcare provider acquisitions between 2006 and 2015.

By 2018, 8 percent of health systems' acquisition volume will be made up of digital health startups, up from 1 percent in 2014, according to a report from Accenture, which made projections based on an analysis of 1,500 healthcare provider acquisitions between 2006 and 2015.

Accenture defines digital health startups as companies that are developing sensors, analytics, and cloud tools for offerings like remote patient monitoring and telehealth.

“To deal effectively with greater complexity, higher volumes and other changes resulting from increased acquisitions, industry providers will need to manage their businesses with the mindset of a portfolio manager,” Kristin Ficery, managing director of health provider consulting at Accenture, said in a statement. “Rather than viewing deals as one-off opportunities, the best-prepared executives will systematically manage a potential deal as a product of the whole.”

The report estimates that, in the first half of 2015, healthcare set a year-to-date record in acquisition volume of $241 billion. Besides the need to expand digital health capabilities, these acquisitions have been driven by a shift from volume to value-based care and competition in local markets, Accenture found.

Earlier this week, Accenture published the results from its annual Accenture Technology Vision 2015 survey, which includes responses from more than 1,000 executives in developed and developing markets across various industries, including more than 100 from the life sciences. Some 70 percent of the life sciences executives surveyed said that the next generation of digital health platforms will not be led by technology companies, but by healthcare and life sciences companies.

About 60 percent said they plan to form partnerships with new technology companies over the course of the next two years. In developed markets, 45 percent of the respondents said they’re already using industry platforms to share data with digital business partners — and 26 percent said they were experimenting with such initiatives currently.