Services from telemedicine to retail clinics to concierge care services are disrupting primary care, and primary care practices need to adapt to stay relevant, according to a new report from PricewaterhouseCoopers' Health Research Institute (HRI). HRI interviewed 25 executives from industry, trade associations and academia and surveyed 1,500 clinicians and 1,000 consumers for the report.

Services from telemedicine to retail clinics to concierge care services are disrupting primary care, and primary care practices need to adapt to stay relevant, according to a new report from PricewaterhouseCoopers' Health Research Institute (HRI). HRI interviewed 25 executives from industry, trade associations and academia and surveyed 1,500 clinicians and 1,000 consumers for the report.

"With rising costs and increased demand, primary care practitioners need to rethink their business models to unlock value – and be rewarded for their contributions," Dr. Simon Samaha, a principal in PwC's US Health Industries practice, said in a statement. "We're going to see non-traditional players shake up the industry using new technologies and innovative approaches focused on convenience for patients and value for providers."

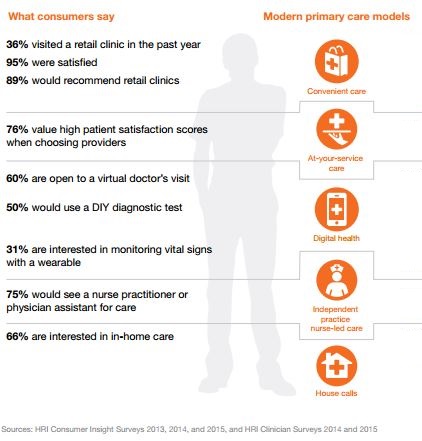

Eight in 10 consumers told HRI they were open to looking beyond the traditional doctor visit for their care. Thirty-six percent had visited a retail clinic in the past year, and 95 percent of those were satisfied with the care they received. Sixty percent were open to a virtual doctor’s visit, half said they would use a DIY diagnostic test, and 31 percent expressed an interest in monitoring vital signs with a wearable. Seventy-five percent were willing to see a nurse or a nurse practitioner rather than a doctor and 66 percent were interested in in-home care.

All this points to a market where patients will go to a variety of different providers for their basic health needs, PwC wrote in the report. Primary care providers, then, have to figure out how they fit into that evolving ecosystem.

"Primary care needs to shift from its traditional role of 'gatekeeper' to an array of specialties and instead become a more engaged, central part of the system. This change is being driven by the demands for greater value, consumer need for convenience, and changing health demographics," Kelly Barnes, US health industries leader at PwC said in a statement.

Asked how they were responding to these changes in the market, 68 percent of primary care providers said they were making no change. But 18 percent said they would provide new services, including, variously, virtual technology, one-stop-shopping, behavioral health services, pharmacist services, house calls, or group visits. Fourteen percent increased delivery of services they already provided. And 10 percent were partnered with retail clinic, with another 9 percent planning to do so.

One more interesting tidbit in the report is the finding that Hispanics overindex on mobile health engagement by a significant margin. For instance 14 percent were using mobile health technology to monitor or diagnose a health condition compared to 5 percent of the general population and 31 percent used mobile health to make appointments, compared to 5 percent of the general population. They were also more likely to visit a retail clinic or use virtual care.

Global health analyst Jody Ranck noted the mobile engagement of that community in an interview with MobiHealthNews five years ago, noting that it underscored the importance of developing Spanish-language mobile health apps.