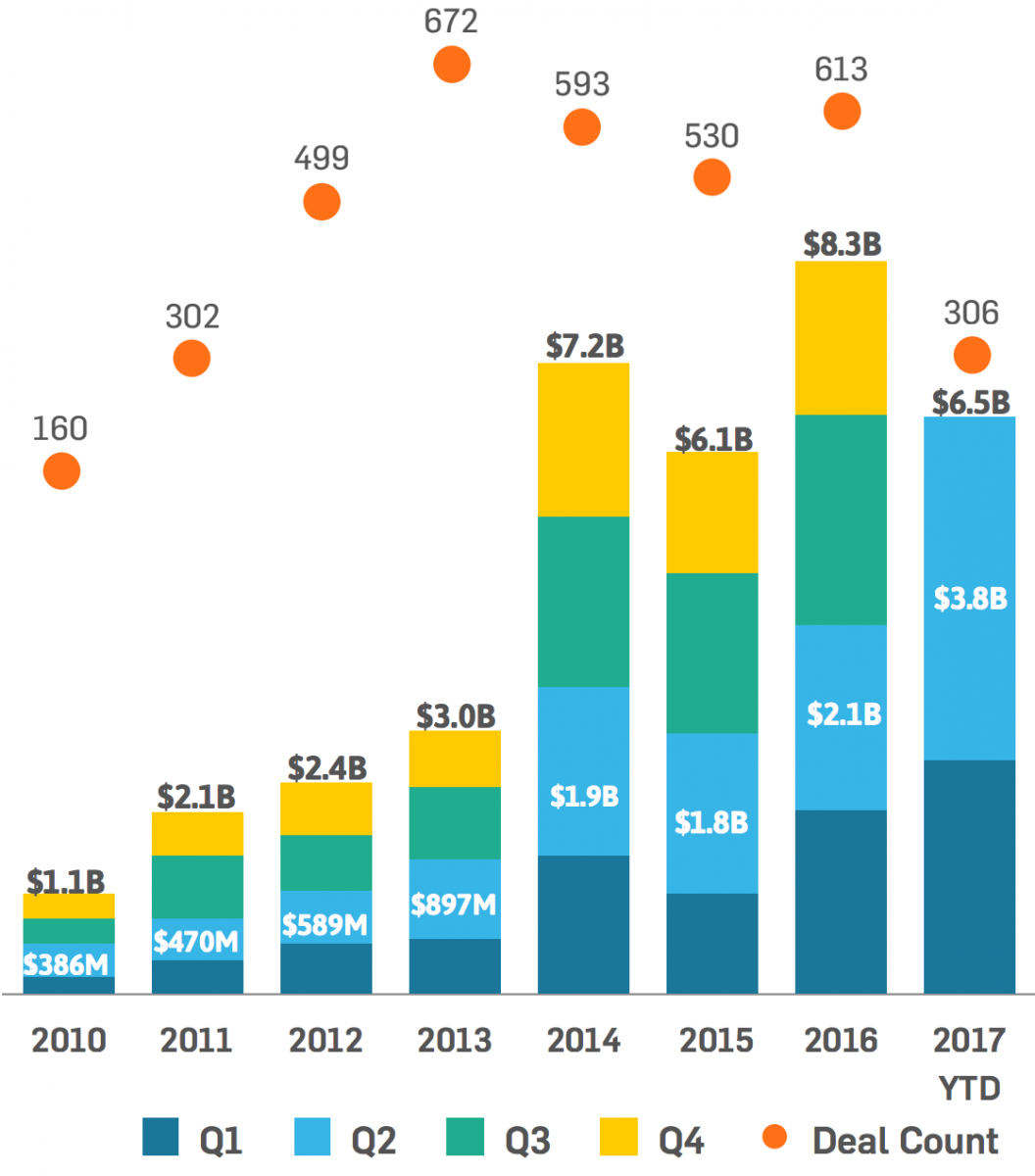

StartUp Health’s funding report for the first half of 2017 is out, and the organization is predicting that it will be the biggest year yet for digital health funding. The total raised in the second quarter was $3.8 billion, adding up to $6.5 billion to date this year.

StartUp Health’s funding report for the first half of 2017 is out, and the organization is predicting that it will be the biggest year yet for digital health funding. The total raised in the second quarter was $3.8 billion, adding up to $6.5 billion to date this year.

“The industry hit a major milestone in Q2 2017 with a staggering $3.8B total invested,” the new report states. “In fact, this last quarter alone was larger than total annual funding for 2010 and 2011 combined.”

While there was plenty of investment during the quarter (with 538 unique investors), a lot of the quarter’s record size can be attributed to a few large deals. The two biggest deals this quarter — $914 million for early cancer detection startup Grail and $600 million for Outcome Health, a maker of waiting room screens and tablets for patient education and pharmaceutical marketing — were also the two biggest digital health deals of all time, or at least since StartUp Health began tracking the space in 2010.

In fact, all 10 of the year’s 10 biggest deals were $100 million or more. Just one more deal above $100 million will give 2017 the record for most deals over $100 million.

The report includes a few other interesting insights. Big Data and Analytics was the area where the most total funding was raised at $1.2 billion, but most of that total is accounted for by Grail. Education and Training had the largest average deal size, at $156 million, and Patient/Consumer experience had the most deals, with 56 tracked by StartUp Health.

Tracking the average size of different stage funding rounds, the report shows that Series B rounds are getting much bigger, while seed, Series A, and Series C are all holding steady or dropping.

The biggest investors this quarter were Khosla Ventures and GV (Google Ventures), with seven deals each. GE Ventures and Accel trailed with six each, while Flare Capital, Norwest, Sequoia, and Temasek each made five. (And StartUp Health seems to have excluded Temasek’s $800 million investment in Verily.)

“Already, 2017 has seen almost as many unique investors active in the space as in all of 2014,” the report says. “This is perhaps one of the more notable trends, showing us that investors continue to find health innovation to be an exciting opportunity to deploy capital.”