Healthcare IT venture capital funding hit $1.4 billion this quarter, according to a new funding report from Mercom Capital. That marks an increase of 27 percent over the firm's fourth quarter 2015 numbers, which hit $1.1 billion. It's also an increase of 74 percent year-over-year for the quarter.

Healthcare IT venture capital funding hit $1.4 billion this quarter, according to a new funding report from Mercom Capital. That marks an increase of 27 percent over the firm's fourth quarter 2015 numbers, which hit $1.1 billion. It's also an increase of 74 percent year-over-year for the quarter.

"The Health IT sector is off to an impressive start this year with significant funding activity in the first quarter led by wearables, data analytics and telemedicine," Raj Prabhu, CEO and Co-Founder of Mercom Capital Group, said in a statement. "Data analytics and telemedicine companies reached a significant milestone, each crossing $1B in funding raised to date. Health IT public companies, meanwhile, continued to underperform."

Consumer-centric companies raised more than enterprise-centric companies, with $796 million spread over 97 deals compared with $569 million over 49 deals. The most well-funded category, wearables, brought in $260 million, followed by data analytics with $197 million, telemedicine with $171 million, mobile health with $120 million, and consumer health information/education with $100 million.

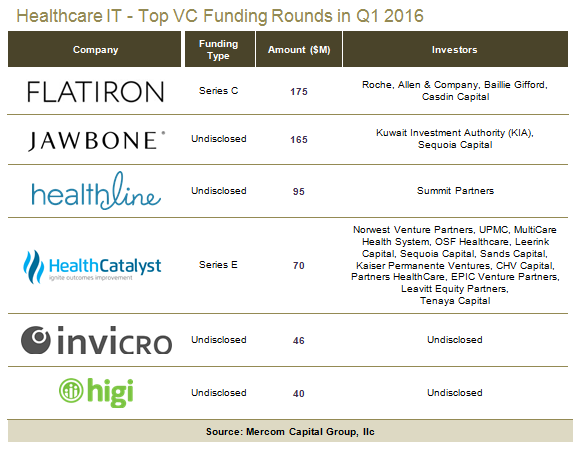

Some of the biggest rounds were Flatiron's $175 million round, Jawbone's $165 million round, the $95 million raised by Healthline, and $70 million raised by Health Catalyst. Some of the most prolific investors, with three deals each, were Chicago Ventures, Jazz Venture Partners, Jump Capital, Lux Capital, Sequoia Capital, Social Capital, Tribeca Venture Partners and UPMC.

The report also looked at M&A, tracking a record 58 deals in the quarter, including nine mobile health app companies. The top disclosed acquisitions were the $2.75 billion acquisition of MedAssets by Pamplona Capital Management, the $2.6 billion acquisition of Truven Health Analytics by IBM, the $950 million acquisition of Netsmart Technologies by Allscripts, the $140 million acquisition of CenTrak by Halma, and the $119 million acquisition of MedicalDirector by Affinity Equity Partners.