With more and more mobile health apps releasing each year and slower growth in the number of users downloading, financial success is becoming less likely for developers without substantial backing, data from a recent market research report suggests.

With more and more mobile health apps releasing each year and slower growth in the number of users downloading, financial success is becoming less likely for developers without substantial backing, data from a recent market research report suggests.

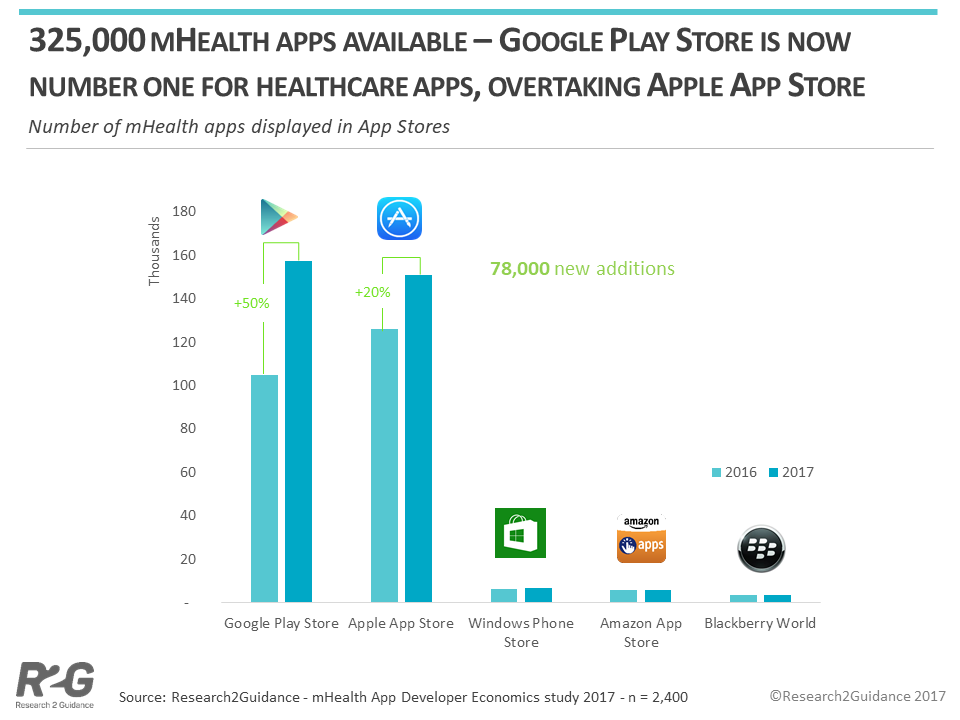

According to the mHealth Economics 2017 study — an annual Research2Guidance survey which this summer polled 2,400 mobile health stakeholders — there are approximately 84,000 health app publishers, and a total of 325,000 health apps currently available in the major app stores (not accounting for multi-store releases).

Approximately 78,000 of these health apps were added within the past year alone. The rate of total annual app downloads also increased over the past year but, as Markus Pohl, cofounder and research director of the mHealth App Developer Economics Program explained, this increase in new downloads pales in comparison to the number of new apps being released. As the growth in supply appears to be outstripping that of demand, only the developers with substantial investment support will be able to rise to the top of a crowded market, he said.

“Developing and publishing mobile health apps has become a serious business and a profession,” Pohl told MobiHealthNews. “A couple of years ago there were a lot of ‘one man shows’ that put out an app and it became a success story, or put out an app and it made some money. But nowadays to be successful in mobile health app publishing you need to invest. You need to invest to develop the app, and you need to invest in marketing, either a lot of time or a lot of money. I don’t want to say it’s the only [way], but this is how to do it nowadays.”

There’s also been a major change to where the wealth of new apps are being released. For the first time, there are more health apps available on the Google Play Store than there are on Apple's App Store, a outcome that Pohl said was becoming more apparent with each year’s report.

“It was kind of foreseeable that Android would overtake Apple at one point in time, at least in terms of numbers of mHealth apps,” he said. “There’s a very clear duopoly … that’s Android and Apple, and apart from this it’s not really big. Microsoft is kind of out of the way, Blackberry is hardly alive, and Amazon — which I think is still a player. But nothing compares to those two. If you’re into developing and marketing mobile health, you’re stuck with those two.”

In terms of investment, app developers in their infancy are primarily receiving financial support from incubators and accelerators. The bulk of the industry’s funding is coming in from venture capitalists, and most often from investors based in the US. In total, the report estimates a total of $5.4 billion was poured into the industry by early stage investors during 2016.

As for the health app publishers themselves, Pohl noted that the market continues to be “very attractive” to those both within healthcare and without. The report classified 60 percent of market participants as coming from within the healthcare industry, 23 percent as non-healthcare, with all other players consisting institutions or uncategorized sources. Of note, the report also classified 28 percent of those participating in the industry as purely digital market players, a group nearly outnumbering those coming from traditional healthcare.

Pohl and his colleagues also saw a stark shift in anticipated channels of app distribution. In surveys asking players how they envision the coming five years, respondents appeared less confident than previous years in the market potential of every channel, with the clear exception of health insurers.

“The popularity of health insurers as a distribution channel has been slowly increasing over the years, and has even overtaken ‘app stores’ as the best distribution channel,” researchers wrote in the report. “Nearly all distribution channels that have been considered effective have disappointed mHealth app publishers. In 2010, ‘hospitals’ and ‘physicians’ were thought to be the best future distribution channels, but have lost a lot of their appeal over the course of seven years, as did ‘healthcare webpages’ and ‘pharmacies.’”