Health-specific incubators and accelerators have been expanding and proliferating for the past two years, and they seem to be making an impact -- Rock Health, for instance, recently announced that their average startup is valued at $5.2 million. But do these relatively new, health-focused accelerators have staying power? That's the question a new report from the California Healthcare Foundation seeks to answer.

Health-specific incubators and accelerators have been expanding and proliferating for the past two years, and they seem to be making an impact -- Rock Health, for instance, recently announced that their average startup is valued at $5.2 million. But do these relatively new, health-focused accelerators have staying power? That's the question a new report from the California Healthcare Foundation seeks to answer.

In "Greenhouse Effect: How Accelerators Are Seeding Digital Health Innovation", author Aaron Apodaca talked to various experts about the unique challenges for health accelerators. For one thing, traditional technology accelerators rely to some extent on the occasional blockbuster startup exiting through a major IPO. There are very few examples of that happening in health IT, so incubators need to be more selective, the report suggests, and bank on a majority of the supported companies doing well.

Another consideration, Apodaca writes, is that many -- though not all -- of the startups running through incubators now are direct to consumer health services of some kind, whether apps, devices or online services. But experts interviewed in the report, like HealthTech Capital founder Anne DeGheest, said many investors still consider that to be an unproven, untested market vector.

Companies might have needs beyond business mentorship that incubators don't meet, Apodaca suggests, like getting companies in real world contact with their customers. Additionally, incubators can attract entrepreneurs with great product ideas that don't necessarily translate to good business ideas -- and might be better off seeking to sell their idea to an existing company.

Finally, Apodaca suggests that the unique nature of the healthcare field could mean that startups need more time and capital than they do in mainstream incubators like Y Combinator. He points to the trend of companies hopping from one accelerator to another in the health space as evidence that they are not getting longterm enough guidance.

The report goes on to indicate that so far, the incubators seem to be doing well, based on valuations, profitability, and additional funding raises so far for various companies. The experts he spoke to also weighed in on how health tech incubators can maximize their chances of success: Apodaca lays out 12 bullet points of advice for incubators, broken down by which sector the advisor comes from.

The report concludes with a prediction that the incubator scene will continue to grow: Apodaca predicts that by the end of 2013, there will be hundreds of incubator graduates and more than 20 programs worldwide. He predicts a rise in strategic partnerships like StartUp Health's recent collaboration with GE Healthcare, and finally that the trend of companies going through multiple accelerators will continue, not just because more time and capital is needed to develop a health company, but also because the incubators will become more specialized, each offering different opportunities for growth.

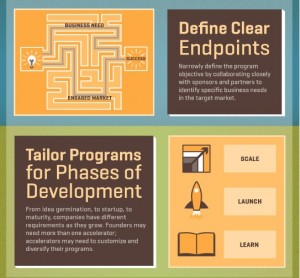

Apodaca's advice for incubators is to bring in health experts, be willing to confront difficult questions about profitability and marketability, focus on creating market synergies, define clear endpoints for businesses, and meet companies where they are, customizing programs for different stages of company development.

MobiHealthNews also looked at health accelerators as one of our top trends of 2012 in our Q4 2012/Year-end State of the Industry Report.