The first three months of 2014 have proven to be eventful. Among arguably much more important events, Apple hired a whole lot of medical sensor experts for some unknown reason – most suspect for the rumored iWatch. More NBA players started wearing health tracking devices. The Google Flu Trends debacle got some scholarly attention. Disney helped launch a tooth brushing app for kids. Facebook bought a virtual reality company for $2 billion that it might use for remote doctor visits someday. And a company called HealBe said it had developed a device to passively track caloric intake.

Apple’s rumored digital health debut looms as others step up

![]() The increasing number of digital health hires made by Apple fueled rumors about an iWatch and a rumored all-in-one health tracking app that Apple is reportedly working on, called Healthbook. Meanwhile, Samsung has started embedding heart rate sensors directly into their newest smartphones. And after a quiet meeting with the FDA became big news, Google announced that its moonshot lab is working on contact lenses that it hopes will be able to noninvasively monitor glucose. In the past three months Sony, LG, Virgin, and Epson also all announced activity tracking devices. At the same time passive activity tracking via smartphone apps has trended up thanks in part to the addition of the M7 chipset to Apple’s latest generation of mobile devices.

The increasing number of digital health hires made by Apple fueled rumors about an iWatch and a rumored all-in-one health tracking app that Apple is reportedly working on, called Healthbook. Meanwhile, Samsung has started embedding heart rate sensors directly into their newest smartphones. And after a quiet meeting with the FDA became big news, Google announced that its moonshot lab is working on contact lenses that it hopes will be able to noninvasively monitor glucose. In the past three months Sony, LG, Virgin, and Epson also all announced activity tracking devices. At the same time passive activity tracking via smartphone apps has trended up thanks in part to the addition of the M7 chipset to Apple’s latest generation of mobile devices.

Mergers and acquisitions stay strong in digital health

During the first quarter of 2014 MobiHealthNews tracked eight acquisitions for digital health companies – almost none of which disclosed the financial details.

UnitedHealth division Optum acquires a majority stake in Audax Health Solutions. The deal “included cash, options, preferred stock, and significant working capital,” according to the companies. The near-acquisition will not affect Audax’s existing relationships with customers, including Cigna, whose CIO Mark Boxer sits on Audax’s board.

Intel confirmed rumors that it had bought Basis Science. Basis Science, the activity tracker company that makes the high-end Basis B1 Band, got snapped up by Intel for between $100 million and $150 million, according to press reports. Earlier this year Basis was reportedly soliciting Google, Apple, Samsung, and Microsoft for a buyout at a price point below $100 million. Notably, Intel Capital became a Basis investor last October and joined the company’s board at that time. Other Basis investors included Norwest Venture Capital Partners, DCM, and Mayfield Fund. The startup raised just over $30 million in total.

Intel confirmed rumors that it had bought Basis Science. Basis Science, the activity tracker company that makes the high-end Basis B1 Band, got snapped up by Intel for between $100 million and $150 million, according to press reports. Earlier this year Basis was reportedly soliciting Google, Apple, Samsung, and Microsoft for a buyout at a price point below $100 million. Notably, Intel Capital became a Basis investor last October and joined the company’s board at that time. Other Basis investors included Norwest Venture Capital Partners, DCM, and Mayfield Fund. The startup raised just over $30 million in total.

AirStrip buys assets of Sense4Baby. San Antonio, Texas-based mobile healthcare company AirStrip acquired the assets of wireless monitoring startup Sense4Baby and licensed the associated technology that the startup was founded on from the Gary and Mary West Health Institute. The companies did not disclose the financial terms of the transaction. Sense4Baby raised $4 million from the West Health Investment Fund in early 2013. The FDA-cleared Sense4Baby offering is a packaged kit that includes the wearable monitoring device and either a dedicated smartphone or tablet with pre-loaded Sense4Baby software. The company also offers providers a web-based portal that allows them to view or review all that data entered through the mobile app as well as the monitoring data. The offering is currently FDA-cleared for use by providers to conduct non-stress tests on high-risk pregnancy patients in clinical settings. AirStrip said it plans to roll out Sense4Baby to providers as planned, but it also aims to develop a version of the offering that patients can use at home.

Vocera snaps up mVisum. Vocera Communications announced that it had acquired alarm management company mVisum for $3.5 million. “The acquisition of mVisum is another step in our strategic roadmap to solve one of healthcare’s biggest challenges: communication,” Brent Lang, the President and CEO of Vocera said in a statement. “Communication breakdowns caused by alarm fatigue have become a top patient safety concern and a regulatory priority. mVisum’s alarm management technology instantly delivers data to clinical decision makers and complements our secure, mobile communication solutions to help improve patient care, safety and satisfaction.”

Welltok buys Mindbloom. Health management platform provider Welltok announced the acquisition of wellness app maker Mindbloom. Welltok will incorporate Mindbloom into its CafeWell Health Optimization Platform. Since its founding in 2008, Mindbloom has disclosed about $1.8 million in funding from Seattle-area angel investors. Mindbloom offers users a series of apps aimed at helping users improve their lives. One app, Juice, was created in conjunction with Premera Blue Cross to help users track which aspects of their routine affect their energy. Another app, Lifegame, uses a virtual tree to represent the different spheres of life like health, career, and spirituality. To make the tree grow users have to water it by taking small actions toward those goals.

Welltok buys Mindbloom. Health management platform provider Welltok announced the acquisition of wellness app maker Mindbloom. Welltok will incorporate Mindbloom into its CafeWell Health Optimization Platform. Since its founding in 2008, Mindbloom has disclosed about $1.8 million in funding from Seattle-area angel investors. Mindbloom offers users a series of apps aimed at helping users improve their lives. One app, Juice, was created in conjunction with Premera Blue Cross to help users track which aspects of their routine affect their energy. Another app, Lifegame, uses a virtual tree to represent the different spheres of life like health, career, and spirituality. To make the tree grow users have to water it by taking small actions toward those goals.

Physicians Interactive has acquired Tomorrow Networks, a joint venture between mobile clinical resources company Physicians Interactive and New York City-based Remedy Systems. Tomorrow Networks billed itself as a mobile advertising network that served ads specifically targeted to healthcare providers and patients based on their specialties, conditions, and locations — among other contexts.

Bioscape Digital acquires PictureRx. Atlanta-based Bioscape Digital bought Chattanooga-based Picture Rx to build out its tablet-based patient engagement platform. PictureRx had previously raised $2 million in grant funding from the National Institutes of Health. Although the company did not disclose the terms of the deal, CEO Stuart Bracken told MobiHealthNews that “inherently it makes sense that it would be north of that $2 million number.” Bioscape will remain in Atlanta but will open an office in Chattanooga. Bracken said the whole PictureRx team is remaining on board.

Healthsparq bolsters platform with ClarusHealth buy. Portland, Oregon-based Cambia Health subsidiary HealthSparq, an online shopping platform for healthcare services, has acquired ClarusHealth Solutions, an online provider search tool, for an undisclosed amount. The acquisition triples Healthsparq’s payor clients, bringing the number from 20 to 60 health plans, a total of 60 million consumer users.

The rise of the digital health IPO

This quarter marked a rise in digital health IPOs. While there were only four IPOs announced or launched during the quarter, even one digital health IPO has been a rare occurrence in quarters past.

Castlight Health IPOs. Castlight Health debuted on the New York Stock Exchange with an IPO that raised about $180 million for the company, much more than it previously estimated. The company’s stock then ramped up more than 160 percent during its first day and closed at a price that valued the company — which only had $13 million in revenues last year, at more than $3 billion. Castlight describes its offering as “the first enterprise healthcare cloud” that offers employers and their employees and families tools about healthcare pricing, quality, and other kinds of “convenience information” that help patients make well-informed decisions.

Everyday Health IPOs. New York-based Everyday Health raised more than $100 million in its IPO. Everyday Health offers users an app and web tool to aggregate health information on a variety of topics, including nutrition, diabetes, fitness, digestive health, heart health and auto immune diseases. The company also offers free newsletters for those that want to get health and wellness information in their inbox. Everyday Health initially filed for an IPO in January 2010, but withdrew the filing that November. The company cited “changed circumstances regarding security markets” as the reason for pulling back on its IPO plans in 2010.

Everyday Health has raised close to $90 million from VCs to date, according to SEC filings. The company’s investors include BEV Capital, NeoCarta Ventures, Rho Capital Partners, Technology Crossover Ventures, and Scale Venture Partners. Former AOL CEO Steve Case’s investment firm Revolution has also invested in Everyday Health.

Imprivata files for IPO. Lexington, Massachusetts-based Imprivata confidentially filed a draft statement with the Securities and Exchange Commission (SEC) for an initial public offering during the quarter too. Imprivata’s products include OneSign, a single sign-on, authentication system that includes biometric identification as well as virtual desktop roaming for clinical apps. Its other major offering is Cortext, a secure communications platform for clinicians to use when collaborating with their care team. At HIMSS last year, Imprivata launched a smartphone app called Cortext 2.0 for iPhone, Android, and other platforms via a web-based version. While healthcare is Imprivata’s key area of focus, it also serves other industries, including banking, energy, and government.

Imprivata files for IPO. Lexington, Massachusetts-based Imprivata confidentially filed a draft statement with the Securities and Exchange Commission (SEC) for an initial public offering during the quarter too. Imprivata’s products include OneSign, a single sign-on, authentication system that includes biometric identification as well as virtual desktop roaming for clinical apps. Its other major offering is Cortext, a secure communications platform for clinicians to use when collaborating with their care team. At HIMSS last year, Imprivata launched a smartphone app called Cortext 2.0 for iPhone, Android, and other platforms via a web-based version. While healthcare is Imprivata’s key area of focus, it also serves other industries, including banking, energy, and government.

Imprivata has raised about $50 million to date and its investors include Polaris Partners, Highland Capital Partners, General Catalyst, and SAP Ventures. Its last announced investment was a $15 million third round led by SAP Ventures back in 2008.

IMS Health IPOs. The big data company, which specializes in analytics and services for drug makers, payers, and health care providers, raised about $1.3 billion in its IPO. IMS sold 65 million shares at $20, which gave it a $6.9 billion market cap.

Digital health wakes up to sleep opportunity

While physical activity tracking, diabetes management, and food intake tracking apps and devices have long been a focus for digital health tool developers, this past quarter saw a spike in interest for sleep tracking and management offerings.

While physical activity tracking, diabetes management, and food intake tracking apps and devices have long been a focus for digital health tool developers, this past quarter saw a spike in interest for sleep tracking and management offerings.

While it’s not clear why, Apple hired Roy J.E.M. Raymann from Philips Research, where he led various sleep-related studies. Raymann was a senior scientist at Philips Research who founded the Philips Sleep Experience Laboratory, a non-clinical sleep research lab. He also led projects related to sleep and activity monitoring as part of Philips’ Consumer Lifestyle Sleep Research Program and Philips’ Brain, Body, and Behavior group. Raymann has studied ways to monitor and change sleep patterns by using non-medical methods like “mild skin warming” which could alter sleep-pressure, sleep quality, and alertness. He has also worked on miniaturizing sensors that help track sleep and alertness. Rumor has it Raymann is joining Apple’s rumored iWatch team.

A report from Frost and Sullivan suggested that the sleep diagnostic market was ripe for disruption from less expensive, home health devices. According to the report, the combined US and European market for clinical and ambulatory sleep disorder diagnostic devices was worth $96.5 million in 2013 and is expected to hit $125.8 million in 2017. The report doesn’t include consumer-facing sleep tracking devices, but rather multi-parameter polysomnogram systems that check EEG, ECG, movement, and breathing while sleeping. But even among clinical devices, the market is shifting toward home care.

“Another thing is the availability of patient-friendly sleep testing devices," Frost and Sullivan Healthcare Research Analyst Akanksha Joshi told MobiHealthNews. "People generally prefer to get sleep testing at home, because it’s more comfortable, and costs less out of pocket. And the reimbursement available is quite adequate, particularly in the US. It’s patient-friendly, cost-effective, and people are willing to go for it.”

At the big Consumer Electronics Show in Las Vegas this year, connected health and wellness device company Withings announced a sleep tracking system, called Withings Aura. Aura is offering a different approach than what most sleep tracking systems offer – it has no wearable component. Instead, the system consists of a sensor placed in the user’s bed and a bedside device that serves as both lamp and alarm clock. The system is controlled via a smartphone app. Both components of the sleep system contain sensors. The bed sensor monitors body movements, breathing cycles and heart rate. The bedside device monitors ambient environmental factors like noise, light, and temperature. But the device is also designed to help the user sleep better, not just monitor sleep.

At the big Consumer Electronics Show in Las Vegas this year, connected health and wellness device company Withings announced a sleep tracking system, called Withings Aura. Aura is offering a different approach than what most sleep tracking systems offer – it has no wearable component. Instead, the system consists of a sensor placed in the user’s bed and a bedside device that serves as both lamp and alarm clock. The system is controlled via a smartphone app. Both components of the sleep system contain sensors. The bed sensor monitors body movements, breathing cycles and heart rate. The bedside device monitors ambient environmental factors like noise, light, and temperature. But the device is also designed to help the user sleep better, not just monitor sleep.

Just before CES and a few months before it was acquired by Intel, San Francisco-based Basis Science announced a new advanced sleep analysis feature for its wristworn, multisensor health tracker: “With advanced sleep analysis we are able to do REM sleep, which nobody else can do, and which is what your mind needs to consolidate memories,” a company spokesperson told MobiHealthNews. “[We can do] deep sleep, which your body needs to recover. As well as things like toss and turn, sleep score, interruptions, benchmarking against where you have been and where you are headed.”

Basis Science worked with researchers at the University of California, San Francisco, San Francisco Veterans Affairs Medical Center and the Northern California Institute of Research and Education to validate its advanced sleep analysis feature and compare its results to medical grade devices as well as the more limited sleep tracking features of other leading activity trackers. Basis also used hours of videos of people sleeping to tweak its toss and turn sensing abilities and make sure the data was correlating with what the wearer was actually going through.

Meanwhile, Jawbone, maker of the Jawbone UP activity tracker, launched an app with a very different take on sleep tracking. The app, called UP Coffee, helps users regulate their caffeine intake and understand how caffeine affects their sleep. After three days, the app will compare the user to other coffee drinkers and after one week, the app will provide the user with his or her “caffeine persona”. After 10 days, the app can give the user more actionable information, such as how much sleep the user will lose on average for every 100mg of caffeine he or she ingests.

On the higher end of the market, mattress maker Sleep Number announced a smart bed, called x12, in partnership with sleep tracker maker Bam Labs. Prices for the bed will start at $7,999.99. Bam Labs’ sleep tracker product has formerly only been used in hospital bed systems.

On the higher end of the market, mattress maker Sleep Number announced a smart bed, called x12, in partnership with sleep tracker maker Bam Labs. Prices for the bed will start at $7,999.99. Bam Labs’ sleep tracker product has formerly only been used in hospital bed systems.

Sleep Number’s mattress uses technology called SleepIQ to track and monitor each person’s sleep, show what kinds of comfort adjustments each person can make, and suggest changes the user can make to their daily routine. The bed also tracks each person’s average breathing rate, movement and average heart rate.

Women Founders

During the quarter MobiHealthNews put out a special report on funding in digital health for patient-facing startups. As part of that research, MobiHealthNews writer Aditi Pai put together a chapter on women founders of digital health companies. Of the nearly 400 digital health founders that MobiHealthNews is tracking, only 39 of them were women. It turns out just under 14 percent of patient-facing digital health companies have a woman as a founder or co-founder.

To better understand the experience of these founders and perhaps to explore why this number was so low, MobiHealthNews reached out to some of the women on the list. Read more on that in a previous in-depth report we published during the quarter.

And read on for more a summation of the most important news from Q1 2014 categorized by healthcare stakeholder groups. We also have a wrap-up of all the funding announcements MobiHealthNews tracked during the quarter.

Digital health market industry metrics

By Aditi Pai

Digital health funding reached nearly $700 million in the first quarter of 2014, according to a Rock Health report that specifically looked at companies that raised more than $2 million. The total funding this quarter grew 87 percent compared to the first quarter of 2013. Rock Health looked at around 68 investments for its first quarter report. California-based companies received 32 percent of the funding. Florida-based companies raised close to 23 percent of the total funding beating out Massachusetts, which has raised around 11 percent. Utah and Virginia were the next two on the list.

Rock Health also identified new categories that have been getting investment dollars, including payer administration, telemedicine, alternative health tools, and care coordination. The only repeat category was big data.

The Consumer Electronics Association was also interested in one of these themes. They published a report with Parks Associates that found the wellness products market generated around $3.3 billion in 2013 and will increase to more than $8 billion in 2018 through product sales and software and service revenues, which is a 142 percent growth. Device manufacturers sold more than 40 million wellness products in 2013, according to the report, and this figure will rise to more than 70 million by 2018.

In another survey, Parks Associates found 28 percent of US broadband households have used some type of virtual care communication tool and nearly 20 percent of smartphone and tablet owners use an app to track or manage their fitness activities. The research firm also predicts this figure will increase to 65 percent by 2018 and virtual care doctor-patient video consultation revenues will grow to $13.7 billion.

Another survey found that the global market for EHR-compatible wireless patient monitoring devices, will hit $23.5 billion by 2018, according to a new report from BCC Research. For comparison, that market was valued at $9.6 billion in 2012 and an estimated $11.2 billion in 2013, which adds up to a five-year compound annual growth rate of 16.1 percent from 2013 to 2018.

Another survey found that the global market for EHR-compatible wireless patient monitoring devices, will hit $23.5 billion by 2018, according to a new report from BCC Research. For comparison, that market was valued at $9.6 billion in 2012 and an estimated $11.2 billion in 2013, which adds up to a five-year compound annual growth rate of 16.1 percent from 2013 to 2018.

In the global mobile health market, Europe is likely to surpass North America by 2018, according to one firm. The global mobile health market is expected to grow to $21.5 billion by 2018 with a compound annual growth rate (CAGR) of 54.9 percent, according to a report from BCC Research. The global mobile health market reached $1.5 billion in 2012.

On the other hand, according to a study by Grand View Research, while North America dominated in 2012, Grand View predicts the Asia Pacific market, which includes Australia, India, China, and Japan, will be the fastest growing market, with an estimated CAGR of 49.1 percent from 2014 to 2020. The global mobile health market is expected to reach $49 billion by 2020, according to that firm.

For some of these market predictions to come true, shipments of fitness devices and digital health tools also have to increase.

Health and fitness wearable computing devices will be a main driver of the 90 million wearable devices that are expected to ship in 2014, according to a report from ABI research. ABI also included smart clothing as a category. Projected smart clothing shipments were 30,000 in 2013, and will be 720,000 in 2014 and 1 million in 2015.

Sports and fitness features not only dominate the wearables market, but continue to drive adoption, according to another report from ABI Research. Activity tracking, which includes simple step counting as well as more advanced tracking of specific types of movement, was the most popular feature of wearable devices in 2013 — 16 million wearable devices with this functionality were shipped. After activity tracking, heart rate monitoring was the most popular feature of wearable devices in 2013. ABI said heart rate monitoring wearables saw 12 million units shipped last year.

Sports and fitness features not only dominate the wearables market, but continue to drive adoption, according to another report from ABI Research. Activity tracking, which includes simple step counting as well as more advanced tracking of specific types of movement, was the most popular feature of wearable devices in 2013 — 16 million wearable devices with this functionality were shipped. After activity tracking, heart rate monitoring was the most popular feature of wearable devices in 2013. ABI said heart rate monitoring wearables saw 12 million units shipped last year.

Approximately 1.6 million smartwatches were shipped in the second half of 2013, and over 17 million total wristworn trackers are expected to ship in 2014, according to market research firm Canalys. Fitbit shipped the most wearable bands (58 percent market share), which Canalys suggested could be because Fitbit launched its Flex and Force bands in May and October 2013 respectively. Though, a recent report from the NPD Group also noted that Fitbit shipped a majority of the trackers in 2013 -- NPD counted 67 percent. Earlier, NPD said Fitbits, Jawbone UPs, and Nike FuelBands accounted for 97 percent of all smartphone-enabled activity trackers sold at brick-and-mortar stores or through big ecommerce sites in 2013. NPD also estimated that the digital fitness category is now a $330 million market.

Notably, these stats could be less important in just five years if a prediction from PSFK Labs and iQ by Intel is accurate. The company predicts that predicts wearable devices could make the transition from wristworn trackers in 2014 to health sensors which are completely embedded on or in a user’s body in 2018.

Healthcare provider-related digital health metrics

Sixty-nine percent of providers use a mobile device to view patient information and 36 percent use mobile technologies to collect data at the bedside, according to a HIMSS survey of 170 individuals who held a wide variety of positions in healthcare organizations.

When it comes to reading articles in medical journals, 28 percent of physicians use tablets and 21 percent use smartphones according to a recently published study by ad agency WPP’s Kantar Media. That’s still much lower than the 74 percent that use a desktop or laptop computer or the 55 percent still reading paper journals.

Kantar Media surveyed 3,000 doctors across 22 specialties over two different six month periods for the study. The latest data was collected via questionnaires sent out by mail between May 2013 and August 2013 and an online survey conducted in July and August 2013.

Around 51 percent of physicians told Kantar they use a tablet device for professional purposes. Forty-nine percent said they used a tablet for personal and professional purposes, 19 percent for personal use only, and just 2 percent for professional use only. Adoption was much higher for smartphones — Kantar found that 78 percent used them for professional and personal tasks, 10 percent used them for proffesional tasks only, and less than 1 percent used them for personal tasks only.

Digital health consumer-related industry metrics

Diet and fitness apps were used by 55.7 million American adults in 2013, up from 43.9 million in 2012, according to a study by Kantar Media’s MARS OTC/DTC Study of 20,000 consumers. The study found that 129 million American adults (55 percent of the population) own either a smartphone or a tablet or both.

Diet and fitness apps were used by 55.7 million American adults in 2013, up from 43.9 million in 2012, according to a study by Kantar Media’s MARS OTC/DTC Study of 20,000 consumers. The study found that 129 million American adults (55 percent of the population) own either a smartphone or a tablet or both.

Fifty-two percent of adult smartphone and tablet owners use their mobile health apps more now than they did when they first downloaded them, according to a survey of 1,000 US adults by Wakefield Research, commissioned by Citrix. Citrix released the survey data as well as a report on mobile traffic sourced from ByteMobile subscribers.

While the market for digital fitness tools is doing well, Yale University School of Medicine’s online anonymized survey of 1,000 women ages 18 to 40 found a little over 5 percent of women seek information about reproductive health from smartphone apps, while around 32 percent get information from medical websites.

Only about 1.2 percent of people with diabetes who own a smartphone use a mobile application to manage their condition, according to a report by Research2Guidance. That’s a group of about 1.6 million users. However, the firm predicts that by 2018 that number will rise to 24 million users, or 7.8 percent of smartphone owners with diabetes.

The ability to easily track all this data has made some consumers nervous about privacy. A survey of 2,125 adults with health conditions who are already members of PatientsLikeMe found that 94 percent of adults would be willing to share their health information on social media if it helps doctors improve care even though a majority of those surveyed also understand the data could also be used negatively. The survey was done in partnership with the Institute of Medicine. The same number of people, 94 percent, would also be willing to share their health information on social media if it would help other patients like them and 92 percent would be willing to share information to help researchers learn more about their disease.

Digital health Q1 news summaries by stakeholder group

By Jonah Comstock

Digital health provider news

The first quarter of 2014 saw a surprising high number of hospital pilots and adoptions of mobile and digital health technology, especially in the area of patient engagement, but also several big moves in the area of remote patient monitoring.

The first quarter of 2014 saw a surprising high number of hospital pilots and adoptions of mobile and digital health technology, especially in the area of patient engagement, but also several big moves in the area of remote patient monitoring.

In February, MobiHealthNews released our own report on hospital-branded apps, based on data from September 2013. The report found 205 branded hospital apps, 17 percent of which came from children's hospitals. Sixteen new apps came out between the September data collection and the February report launch.

Patient Engagement

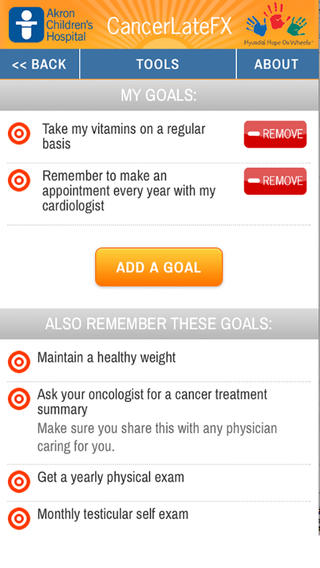

Throughout the quarter, several more hospitals launched notable apps, as well as portal based patient engagement strategies. At the end of January, Akron Children's Hospital launched an app and website for childhood cancer survivors called CancerLateFX created out of a $100,000 grant from Hyundai Hope on Wheels, a nonprofit organization aimed at supporting the fight against pediatric cancer. The app was created to help childhood cancer survivors understand the late effects of their disease and prevention measures that they can use as young adults.

In February, MobiHealthNews broke news about PersonalRN's StrokeApp, a context-dependent app that will anticipate the particular questions stroke patients have based on their demographics, the kind of stroke they’re suffering from, and whether they’re receiving care in the emergency room, the intensive care unit, or inpatient rehab. The app was scheduled to start proof-of-concept testing at hospitals in March. The Cleveland Clinic also launched a new iPad app, called MyEpilepsy, containing both educational materials and tracking tools for patients with epilepsy.

At HIMSS, patient engagement was a major theme. Notably, Kaiser Permanente announced the launch of its patient discharge app, called the Journey Home Board. While the patient is in the hospital, the Journey Home Board is similar to Mayo Clinic’s MyCare app that was piloted last year. It shows a list of appointments or recovery milestones that have to be met before they can go home. It allows them to track progress in a patient diary. When the patient is discharged, the app has additional condition-specific educational and social features.

At HIMSS, patient engagement was a major theme. Notably, Kaiser Permanente announced the launch of its patient discharge app, called the Journey Home Board. While the patient is in the hospital, the Journey Home Board is similar to Mayo Clinic’s MyCare app that was piloted last year. It shows a list of appointments or recovery milestones that have to be met before they can go home. It allows them to track progress in a patient diary. When the patient is discharged, the app has additional condition-specific educational and social features.

Also at HIMSS, Geisinger Health System and PinnacleHealth spoke about the way they're using patient portals for patient engagement, including OpenNotes, a webcam feed to the ICU, and depression screenings. On the other hand, a Mayo Clinic study released in March found that patient portals do not decrease the frequency of office visits.

What might decrease the frequency of office visits is Zipnosis's virtual visit technology, which announced the start of a wide rollout in March. At Fairview Hospital, where it's been being quietly piloted for hte last few years, Zipnosis led to a 2,000 percent increase in clinical capacity and a savings of about $92 per patient. Its first hospital partner will be the University of Alabama-Birmingham Health System.

Apps for physicians

On the physician side, several more apps and technologies launched this quarter, including at least three Google Glass applications in March.

In February, the Johns Hopkins National Center for the Study of Preparedness and Catastrophic Event Response (PACER) launched two new web apps and updated a third to help hospital first responders and hospital planners prepare for emergency situations, and Penn Medicine began developing an app to help physicians who are prescribing drugs to patients access information about the antibiotics that would work best for their patients. Additionally, physician communication vendor CellTrust announced a pager replacement system using the Samsung Galaxy Gear smartwatch.

But mostly, the wearable tech being rolled out in hospitals was Google Glass. First, in March, UCLA engineers developed a Glass app for reading diagnostic test strips. Then, Rhode Island Hospital began a feasibility study of Google Glass in the ER. For six months, emergency room patients who require a dermatology consult and consent to the study will be examined by ER physicians wearing a stripped-down version of Google Glass. The wearable will transmit images to an off-site dermatologist, who will access them via a tablet. Finally, at a Nuance health event at the end of March, John Halamka of Beth Israel Deaconess Medical Center mentioned that his hospital has begun using Google Glass for patient care as well.

Patient monitoring and diagnostics

In patient monitoring, the quarter started off with an impressive validation for iRhythm's ZIO patch, which Scripps Health found to detect more arrhythmia events than a traditional Holter monitor and provide a better experience for patients. Aetna took notice of that research too, and began reimbursing for the ZIO patch later that month.

In patient monitoring, the quarter started off with an impressive validation for iRhythm's ZIO patch, which Scripps Health found to detect more arrhythmia events than a traditional Holter monitor and provide a better experience for patients. Aetna took notice of that research too, and began reimbursing for the ZIO patch later that month.

Diabetes management software and cable maker Glooko got into the clinical scene in a big way this quarter, partnering with Joslin Diabetes Center to develop a "virtual Joslin" diabetes management platform. About a month later, the two partners released a population health management tool which gives hospitals a way to manage all the data coming in from patient glucose monitors and flag patients with hypo- or hyperglycemic events or trends.

A few other patient monitoring companies made hospital news during the quarter: Vantage Health began testing point-of-care chemical sensor apps with Scripps Health, Ginger.io started a psychotic illness trial at UC Davis, and AliveCor announced a deal to integrate with Practice Fusion EHR systems.

Digital health-related government and regulatory news

The first quarter saw relatively few pieces of government news in the mobile health sector, but what news did break was big: ongoing friction between the FDA and Congress regarding mobile medical apps, the ONC finally launching Blue Button Connector after a delay, and a surprising amount of news out of the Center for Medicare and Medicaid Services. There were also a good number of FDA clearances.

The ONC's BlueButtonConnector is a website meant to be a hub for consumers to find sources of health data to download as well as Blue Button Plus technology to facilitate managing that data. The planned mid-January release was pushed to late February for several reasons, including a moratorium on new government websites until healthcare.gov was stabilized, and some preparation time lost from the government shutdown. The Connector did launch in late February (during HIMSS) but it was a soft launch, an "early release" version to solicit input and get more software on the platform before a large, public launch.

The ONC's BlueButtonConnector is a website meant to be a hub for consumers to find sources of health data to download as well as Blue Button Plus technology to facilitate managing that data. The planned mid-January release was pushed to late February for several reasons, including a moratorium on new government websites until healthcare.gov was stabilized, and some preparation time lost from the government shutdown. The Connector did launch in late February (during HIMSS) but it was a soft launch, an "early release" version to solicit input and get more software on the platform before a large, public launch.

The main government news this quarter was more on the long, slow chess game between Congress and the FDA over mobile health app regulation. In February, a group of Senators introduced the PROTECT Act, a companion to the SOFTWARE Act introduced in the House last quarter. At the time, we noted eight types of app the PROTECT Act would deregulate. Meanwhile, the FDA continued working on the FDASIA report to Congress, required by the FDA Safety Act and already several months late. That report finally published in April. Additionally, six senators sent the FDA an open letter inquiring about the status of regulation. The ONC and the FDA also threw their support behind West Health's medical device interoperability standards initiative at an event in March.

Some local Medicare and Medicaid groups made reimbursement news this quarter. In February, Ohio passed legislation requiring Medicaid to reimburse them for telehealth. Wyoming Medicaid teamed up with Wildflower Health to launch an app for pregnant women. Finally, a Florida Medicare Advantage Plan, AvMed, began for its members' activity trackers, in this case the Fitlinxx Pebble.

Finally, the quarter saw seven notable FDA 510(k) clearances. January clearances included Kinsa Health's connected thermometer, Samsung's S Health app, EarlySense's passive bedside monitor, and AlereConnect's home health hub HomeLink. In February, we reported on clearances for clinical trial activity trackers from UK company Camntech and Carestream's radiology viewing app VUE Motion. Finally, in March, HealthInterlink's Beacon 2.0 software, also a home health hub, received clearance. The FDA also published draft guidance on pharma social media. (Correction: A previous version of the article said the FDA published final guidance on social media.)

Digital health-related health insurance company news

This quarter, Chilmark Research reported on a new trend amongst payers: partnering with biometric tracking device makers. The firm also said payers were backing off of apps.

“Payers have drastically pulled back from their flurry of experimentation in 2012, and are now focusing their efforts into fewer, more precise areas where they believe market traction awaits,” the researchers wrote. “In addition, the rush to create mobile app versions of member service portals has slowed, as have health and wellness app launches.”

Still, there has been plenty of payer action this quarter in the form of ~~~. United and Aetna were the busiest major payers this quarter, but a surprising amount of movement came from the Blues as well.

Still, there has been plenty of payer action this quarter in the form of ~~~. United and Aetna were the busiest major payers this quarter, but a surprising amount of movement came from the Blues as well.

UnitedHealth Group started off making two pieces of news at CES: the launch of its myEasyBook online appointment booking and price checking tool, and initiating a pilot to test the Zamzee kids' activity tracker in populations of children with diabetes. But the payer's biggest news came a little later in the quarter, when it purchased a majority stake in Audax Health, becoming the second large payer to buy a digital employee wellness platform.

Aetna's biggest news was probably CEO Mark Bertolini's HIMSS keynote, where he told the crowd that Aetna's focuses going forward will be ACOs and consumer health. The payer also launched a pilot in January to give smartphones to caretakers in Illinois, and officially recognized the ZIO Patch for reimbursement. Finally, Aetna quietly shut down InvolveCare, an app for caregivers it launched just last fall.

Across the quarter, we also saw a smattering of news from local Blues. In January, Premera Blue Cross launched a nutrition-focused online platform and app, called Serve it Up!, in partnership with social platform maker Wellness Layers and nutrition guidance program Guiding Stars. In March, Blue Cross Blue Shield of Massachusetts launched a secure health and wellness website for members called ahealthyme. Finally, Blue Cross Blue Shield Venture partners led a round of investment in behavior change startup AbilTo.

Digital health-related Q1 pharma news

We've always categorized pharma movement in digital health as slow but steady, but this quarter saw indications that the sector is starting to pick up speed. A notable IMS report took pharma to task for its slowness to adopt social media, although it noted that Johnson and Johnson is far outstripping its peers in that category. Recently finalized FDA guidance could also move that needle going forward.

Pfizer backed startup Akili in the development of a mobile game to help diagnose patients with Alzheimer's. In the future, the game could be used in the treatment or detection of ADHD and autism, among other conditions.

Pfizer backed startup Akili in the development of a mobile game to help diagnose patients with Alzheimer's. In the future, the game could be used in the treatment or detection of ADHD and autism, among other conditions.

The biggest news this quarter came from Merck, which unveiled a range of digital and big data projects its been working on with healthcare stakeholders through its group Merck Medical Information and Innovation (M2i2). M2i2′s partnerships fit into three broad categories: capturing the patient voice, clinician-facing technologies, and innovative uses of data.

One partnership under the M2i2 umbrella was a project with Boston Children's Hospital to turn Twitter and Facebook into a new source for sleep health data — data about how many people in a population suffer from insomnia and what they have in common with each other. Merck Global Health Innovation Fund, the investment wing of the company, made a large investment in WellDoc this quarter as well.

A couple of startups eyed the digital clinical trial market for pharma: Medical micro-journaling startup TapTrak hired Efren Olivares, who has a 22-year pharma background including work with Pfizer, Lilly, Baxter and Dura Pharmaceuticals, and goBalto raised $5 million to build out its clinical trial management software.

On the pharmacy side, health kiosk company higi found its way into 4,000 Rite Aid stores in February.

Digital health-related mobile operator news

Though the mobile operators were fairly quiet as usual, there were a few notable events this quarter, mostly following up on news we reported last year.

AT&T tapped digital health advocate and Scripps cardiologist Dr. Eric Topol to serve as Chief Medical Advisor. Verizon's FDA-cleared home health hub, which secured clearance last quarter, added support for Telcare’s cellular-enabled blood glucose monitoring system and Genesis Health Technologies’ blood glucose monitoring system. And Sprint announced the first class of 10 companies in the accelerator that it debuted last year.

However, a couple pieces of big news came from some smaller operators. Cellular One, a mobile phone service brand that operates in various rural markets across the US, began offering its subscribers in Texas and Louisiana on demand, mobile phone-based video visits and calls with physicians. The mobile operator is offering the service through a partnership with Hilton Head, South Carolina-based iSelectMD. And Telus Health, the healthcare arm of Canadian mobile operator Telus, made a $3 million strategic investment in PatientSafe Solutions in a bid to bring the healthcare communications company to Canada.

Funding roundup for digital health companies in Q1

By Aditi Pai

Flexible sensor maker MC10 raised $20 million from undisclosed investors. MC10's sensors measure various human health signs including vitals and hydration, but the company is also well known for their CheckLight mesh cap, co-developed with Reebok, which is designed to provide realtime feedback about athlete head injuries. The company has previously raised $40 million, bringing its total funding to $60 million. MC10 also alluded to a second strategic investor in December 2012, which MobiHealthNews speculated might be Reebok.

Flexible sensor maker MC10 raised $20 million from undisclosed investors. MC10's sensors measure various human health signs including vitals and hydration, but the company is also well known for their CheckLight mesh cap, co-developed with Reebok, which is designed to provide realtime feedback about athlete head injuries. The company has previously raised $40 million, bringing its total funding to $60 million. MC10 also alluded to a second strategic investor in December 2012, which MobiHealthNews speculated might be Reebok.

Pact (formerly GymPact) raised $1.5 million in a round led by Khosla Ventures and PayPal alum Max Levchin., bringing their total funding to $2.5 million. The company makes deals with their users to start exercising more, eat more, or log food more often. If users do not stick to their pact, the company charges them $5. If they succeed in holding their end of the bargain, they are awarded a certain amount of money.

Digital health platform MyOwnMed raised $1.3 million in funding this past December, according to an SEC filing from late last year. The website and app are meant to record patients' health data in between office visits. The company is led by Founder and CEO Vicki Seyfert-Margolis, a former senior advisor of science innovation and policy to the FDA Commissioner’s Office who has also worked in non-profit medical research circles, academia, and as a director at NIH.

WellDoc, developer of a health platform that supports patients' various health needs, raised $20 million round from Merck Global Health Innovation Fund and Windham Venture Partners. The announcement is WellDoc’s first round using institutional investors — the company previously raised money though angel investors and debt.

WellDoc, developer of a health platform that supports patients' various health needs, raised $20 million round from Merck Global Health Innovation Fund and Windham Venture Partners. The announcement is WellDoc’s first round using institutional investors — the company previously raised money though angel investors and debt.

Wellness app maker Noom raised $4.1 million bringing the company’s total known funding to $6.7 million. The company's main app, Noom Weight, offers users a virtual coach, which assigns the user educational articles and challenges associated with his or her daily schedule. The two other apps, Noom Walk and Noom Cardio, are Android-only apps.

Healthcare Blue Book, a healthcare price transparency tool for consumers and employers, raised $7 million from a strategic investor, The Martin Companies. Nashville, Tennessee-based Healthcare Blue Book has been around since mid-2007, but this is its first funding raise. Charlie Martin, founder of The Martin Companies and former CEO of Vanguard Health Systems, will be an advisor to the company.

MDLive, which offers telehealth services including patient-to-physician remote visits via mobile devices, raised $23.6 million in a round led by Heritage Group with participation from Sutter Health and Kayne Anderson Capital Advisors.

First Opinion raised $1.2 million in a seed round led by Felicis Ventures with additional funding from Greylock, Yuri Milner, and 500 Startups. The company offers an app, primarily targeted towards parents, that acts as a communication system for users to ask doctors health-related questions, including questions about pregnancy, child development, illness and injury, lactation, nutrition and sleep training.

Secure messaging platform TigerText raised $21 million in second round funding to expand its business. Shasta Ventures led the round, with additional investment from OrbiMed, Reed Elsevier Ventures, and TELUS Corporation. Existing investors Easton Capital, New Leaf Venture Partners, and New Science Ventures made up the rest of the round.

Fitmob, a fitness app that lets users find different workouts that they can pay for a la carte, raised $9.8 million from Mayfield Fund, Sillicon Valley Bank and prominent individuals. To use Fitmob, users access a list of indoor and outdoor workouts led by trainers in the user’s city. The more workouts the user attends, the cheaper the workouts will be. Each workout session costs $15 if the user chooses to go once a week, $10 if the user chooses to go twice and $5 if the user goes three or more times per week.

Fitmob, a fitness app that lets users find different workouts that they can pay for a la carte, raised $9.8 million from Mayfield Fund, Sillicon Valley Bank and prominent individuals. To use Fitmob, users access a list of indoor and outdoor workouts led by trainers in the user’s city. The more workouts the user attends, the cheaper the workouts will be. Each workout session costs $15 if the user chooses to go once a week, $10 if the user chooses to go twice and $5 if the user goes three or more times per week.

Noom raised another $2.9 million, completing its round, which the company started earlier in the year. The additional investment brought the total to $7 million. The round was led by New York-based RRE Ventures with participation from TransLink Capital, Recruit Strategic Partners, Scrum Ventures, Qualcomm Ventures and Harbor Pacific Capital. The company’s total known funding to date is $9.6 million.

Nurse scheduling platform OnShift raised $7 million in a round led by HLM Venture Partners with additional funding from Draper Triangle Ventures of Pittsburgh, Early Stage Partners of Cleveland, Fifth Third Capital, Glengary LLC of Beachwood, and West Capital Advisors of Cincinnati. This brings OnShift’s total funding to $15 million.

WellTok raised $22 million third round of funding, which was led by New Enterprise Associates and included participation from another new investor — Qualcomm Ventures. IBM's Watson Fund, which was created to invest in startups that are integrating with Watson, also contributed. Last November IBM announced that WellTok, which offers a health platform called CafeWell, would be one of the first companies to integrate Watson. CafeWell's premium offering, CafeWell concierge, will use Watson to answer users questions based not only on their inquiry, but also on specific information like their location, health status, and health benefits.

MyHealthTeams, which offers niche social network for people with various medical issues, raised $3.36 million this week led by the Westly Group with participation from Adams Street Partners, 500 Startups, HealthTechCapital, Sand Hill Angels, TEEC, and several individual investors. The company will use the money to expand its team and launch new social networks at a faster rate. MyHealthTeams currently has three, but wants to eventually launch 100. The three existing social networks are MyAustismTeam, MyBCTeam, designed for women diagnosed with breast cancer, and MyMSTeam, for people diagnosed with multiple sclerosis.

Medwhat, maker of a health question and answer app, raised $560,000 in seed funding from Stanford University, Stanford Hospital, Startcaps Ventures and a couple of angel investors. The app offers users an ”intelligent personal medical and health assistant that can automatically provide a contextual answer to questions posed in natural language”.

Clue, maker of a fertility tracking app, raised $680,000 (500,000 euros) in a round led by angel Christophe Maire, with additional funding from Joanne Wilson, New York-based Luminary Labs Ventures, and existing investor Thomas Madsen-Mygdal. After the most recent investment Clue still has less than $1 million in funding. Clue uses an algorithm to calculate and predict a woman’s next period.

Clue, maker of a fertility tracking app, raised $680,000 (500,000 euros) in a round led by angel Christophe Maire, with additional funding from Joanne Wilson, New York-based Luminary Labs Ventures, and existing investor Thomas Madsen-Mygdal. After the most recent investment Clue still has less than $1 million in funding. Clue uses an algorithm to calculate and predict a woman’s next period.

Rise Labs, maker of a nutrition coaching app, raised a $2.3 million round led by Floodgate, with additional funding from Cowboy Ventures, Google Ventures, and Greylock, according to TechCrunch. Rise offers users a nutrition coaching system to help them lose weight and make positive lifestyle choices. Users are prompted to take a picture of their food so the coach, a nutrition expert, can see what they are eating and provide assistance based on this information. Rise says one on one nutrition coaching normally costs over $300 per month, but prices for the Rise system start at $15 per week.

San Diego, California-based MD Revolution, which launched its online wellness coaching platform RevUp!, raised $7 million from angel investors. This raise brings MD Revolution’s total funding to $8 million. RevUp!, accessible online, aims to measure a user’s metrics, including DNA, blood tests, biometric measurements, and health goals; monitor the user’s progress while also using predictive intelligence to keep the user on track; and offer tips, feedback, and encouragement from a personal coach. For a limited time, this system is available to users for free.

Ambient Clinical Analytics, a startup that offers mobile hospital data management tools developed at the Mayo Clinic, raised $1.1 million from the Social+Capital Partnership, Rock Health, and the Mayo Clinic. Ambient's first product is called AWARE, which stands for Ambient Warning and Response Evaluation. It’s an interface for EMR data that prioritizes and organizes a patient’s medical information in three ways: by organ, chronologically as a timeline, or as a customized checklist that displays only the next steps relevant to that case.

Voalte, which offers a suite of smartphone-based communication tools to nurses and other hospital caregivers, raised $36 million in a round led by Bedford Funding. Voalte last announced a round of funding back in late 2012 when it raised $6 million from an undisclosed health IT company and an undisclosed healthcare system.

Voalte, which offers a suite of smartphone-based communication tools to nurses and other hospital caregivers, raised $36 million in a round led by Bedford Funding. Voalte last announced a round of funding back in late 2012 when it raised $6 million from an undisclosed health IT company and an undisclosed healthcare system.

Quanttus, a stealthy MIT startup working on wearable vital sign monitoring, raised $19 million in first round funding from Khosla Ventures and Matrix Partners. The company has previously raised $3 million in seed funds from Vinod Khosla. Although the company is still thin on details, Quanttus is developing wearable monitors that the company says “can capture and analyze more than half a million vital sign data points per day.”

PatientSafe Solutions, maker of mobile hospital workflow system PatientTouch, raised a $3 million strategic investment and resale agreement from Telus Health, the healthcare arm of Canadian mobile operator Telus. Telus Health’s investment brings PatientSafe Solutions into the Canadian market, but it also gives Telus exclusive rights to resell the system in Canada.

Kannact raised $3 million in its first round funding from undisclosed angel investors. The company is working on an Android tablet-based home care and remote patient monitoring system called Gladstone. Kannact will use the funding for feasibility testing and development of the product, which has so far only been deployed in pilots. The company is also seeking an additional $3 million in funding.

Stat Health Services, which offers the online doctor visit service Stat Doctors, raised $3.5 million. This brings the company’s total funding to at least $8.8 million to date. Stat Doctors helps patients contact doctors about medical questions 24-7.

Validic raised $1.25 million in convertible notes from SJF Ventures and undisclosed angel investors.The new investment brings the company’s total up to $2.1 million to date, but serves as a bridge to get it to its series A round, which it is in the process of raising now. Validic gives healthcare companies an API connection to access data from the digital health apps and devices.

AbilTo, maker of remote behavioral intervention tools, raised $6 million in a second round of funding led by BlueCross BlueShield Venture Partners and Sandbox Industries. Also contributing to the round was .406 Ventures, which led a $3 million round for the company last year. AbilTo is focused on identifying and remotely treating mental health comorbidities that can negatively affect recovery from medical conditions or events such as cardiac events, diabetes, or breast cancer.

AbilTo, maker of remote behavioral intervention tools, raised $6 million in a second round of funding led by BlueCross BlueShield Venture Partners and Sandbox Industries. Also contributing to the round was .406 Ventures, which led a $3 million round for the company last year. AbilTo is focused on identifying and remotely treating mental health comorbidities that can negatively affect recovery from medical conditions or events such as cardiac events, diabetes, or breast cancer.

Tyto Care raised $4 million in a round led by OrbiMed Israel Partners with additional funding from LionBird. Tyto Care is developing a handheld device that can help patients examine their mouth, throat, eye, heart, lung, and skin. The device can also measure the patient’s temperature. These exams can be guided by a physician online or guided by the device offline.

SenseLabs (formerly Neurotopia), maker of a brain-training headset, raised $4 million. The company has developed a tool to help athletes train themselves to be mentally stronger.

Augmedix, which has developed a Google Glass clinical documentation offering for physicians raised $3.2 million last week in a round led by DCM and Emergence Capital Partners. Other investors included Great Oaks Venture Capital, Rock Health’s LPs (Kleiner Perkins, Mohr Davidow Ventures, and Aberdare), and various angels. Emergence had previously invested in Doximity and Welltok, while Great Oaks is also an investor in Healthtap.

WelVU, a patient education company, raised $1.25 million from a group of angel investors last week. WelVU’s basic app for iPads and iPhones helps physicians create personalized health information videos for patients complete with medical illustrations, images, and conversation topics based on conversations that providers have with their patients.

WelVU, a patient education company, raised $1.25 million from a group of angel investors last week. WelVU’s basic app for iPads and iPhones helps physicians create personalized health information videos for patients complete with medical illustrations, images, and conversation topics based on conversations that providers have with their patients.

Reflexion Health, which offers physical therapy programs that leverage Microsoft Kinect for Windows, raised $7.5 million from the West Health Investment Fund. The Fund was also the sole investor in Reflexion’s $4.25 million seed round in 2012.

TrueVault raised $2.5 million in seed funding from a range of big name investors including FundersClub, Paul Buchheit, ScoreBig founder Joel Milne, and an LLC that includes Andreessen Horowitz, General Catalyst, Maverick, and Khosla Ventures, and Immunity Project founders Reid Rubsamen, Naveen Jain, and Ian Cinnamon. The company, which recently graduated from the Y Combinator incubator, aims to support startups that work with patient health information.

Glooko, maker of a cable that connects glucometers to smarthpones, raised $7 million from Samsung Ventures and Lifeforce Ventures, as well as existing investors including The Social + Capital Partnership, Sundeep Madra and Yogen Dalal. This is Glooko’s third funding raise and its largest to date; it brings the company’s total funding to $11.5 million, including a $1 million seed round and a $3.5 million round last year. The company says it will use the funds to “focus on enabling predictive diabetes care by delivering patient data and decision-making algorithms to health providers and payer groups.”