Weight Watchers' ActiveLink device

Weight Watchers' ActiveLink device

During its quarterly conference call with analysts last week, Weight Watchers confirmed that it had acquired Silicon Valley-based weight loss startup Wello for an undisclosed sum. The acquisition had been rumored for about a week leading up to the conference call. As Weight Watchers CEO Jim Chambers and CTO Dan Crowe explained on the call, the Wello acquisition is an important component of the company's strategy to compete in an increasingly digital weight loss market.

"The competitive frame of the weight loss market continues to evolve as free apps and activity monitors generate significant consumer interest," Chambers said on the call. "...The continued significant year-over-year declines reflect the fact that we are still facing serious challenges, especially in North America and the U.K., which saw declines in paid weeks, both in meetings and online," he explained after noting the company's member recruitment numbers are still declining, but not at an increasing rate.

"We have an ambitious technology vision," Crowe said. "We will become a 21st-century technology organization, engineered for the digital era, whose innovative technology fundamentally improves the way people manage their weight, health and wellness. We will be agile service-oriented, data-driven, cloud-enabled and efficient. We will be a model for digital technology in the markets in which we compete and we will be a magnet for talented innovators both, inside and outside the company."

Crowe noted that Weight Watchers is well-positioned with headquarters in New York City to take advantage of that city's so-called Silicon Alley, while Weight Watchers plans to add a footprint in Silicon Valley, California too -- with Wello as its in.

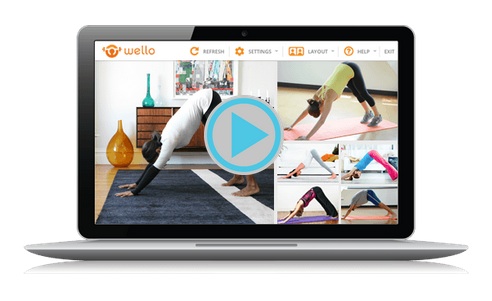

"Earlier this month, we acquired Wello, a San Francisco-based startup that offers one-on-one and group fitness training online delivered with leading-edge technology," Crowe said. "Wello leverages technology to offer consumers the convenience of working out when and where they like, plus the motivation and accountability of a personal trainer. I am impressed with Wello's talent, their technology and their platform for delivering personalized services, which is aligned with [our] personalization agenda... Further, Wello helps us establish a foothold in the Silicon Valley technology community and they will help us develop strategic opportunities."

"Earlier this month, we acquired Wello, a San Francisco-based startup that offers one-on-one and group fitness training online delivered with leading-edge technology," Crowe said. "Wello leverages technology to offer consumers the convenience of working out when and where they like, plus the motivation and accountability of a personal trainer. I am impressed with Wello's talent, their technology and their platform for delivering personalized services, which is aligned with [our] personalization agenda... Further, Wello helps us establish a foothold in the Silicon Valley technology community and they will help us develop strategic opportunities."

Chambers emphasized that while Weight Watchers is bolstering its digital strategy, it would still focus on its human touch approach.

"The strength of the Weight Watchers brand is and always will be in the human connections that make a weight loss journey successful between members and our service provider, between members and other members and between members and their social circles," he said. "Moving forward, we will be bringing this to the digital environment adding human interaction to the online model."

Crowe, who joined Weight Watchers five months ago and has worked at IBM, Deloitte, and AutoTrader.com, admitted that Weight Watchers has been slow to partner with and offer up the latest digital fitness technologies.

"It's obvious that Weight Watchers has had success in the past with technology," he said. "The online offering had been successful in what I would characterize as a mid-2000s technology model and when I arrived the team is still working in that model. We should all appreciate that Weight Watchers' technology runs a large-scale operations, supporting millions of members, millions of downloaded apps around the world and tracking over 1 billion food items in our database, but that is not enough. The great commercial success of our weightwatchers.com products led us to behave as an incumbent and as a result we were slow to adopt the technology capability that is required to meet changing consumer expectation and compete in the digital era characterized by mobile, social, connected devices and open API."

Crowe said the company has a 12-month plan to get back on track and implement its technology strategy, which he says will enable it to launch products in a few months instead of one year. Crowe wants Weight Watchers to iterate its digital tools every two weeks. He also wants the company to "become a strong player in the API economy."

"No one is better positioned than Weight Watchers to be a hub of a weight loss, health and fitness ecosystem, fueled by the latest technology innovation," he said.

Weight Watchers began offering a device made by Philips called ActiveLink to its members in late 2012. Since then the company has sold more than 400,000 of the dedicated fitness tracking devices and the service component has about 10 percent penetration into Weight Watchers member base, the company said.