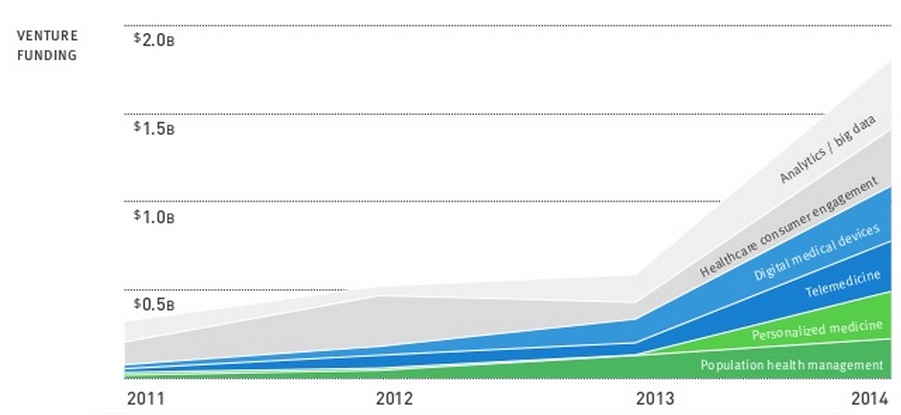

Funding by category, from Rock Health's report

Funding by category, from Rock Health's report

Seed investor Rock Health and digital health academy StartUp Health, two companies that track funding and other data points about digital health, are both reporting 2014 as a record-breaking funding year for digital health in multiple categories.

Rock Health places the total digital health funding for 2014 just over $4 billion, while StartUp Health put the number at $6.5 million. Rock Health's report has digital health accounting for 8 percent of all venture capital funding for the 12-month period between Q3 2013 and Q3 2014.

MobiHealthNews has delved before into the funding methodologies that lead to discrepancies between the two groups. Broadly speaking, Rock Health describes its process as a bit more conservative than most as it only includes funding rounds that are more than $2 million, avoids conflating investment dollars with transactional costs associated with M&A, and has a stricter definition of a digital health company than StartUp Health does.

According to Rock Health's numbers, digital health funding had already surpassed 2013's funding total of $1.8 billion by the second quarter of this year. Year-over-year growth accelerated to 125 percent, up from 30 percent last year, and the compound annual growth rate from 2011 to 2014 hit 45 percent. Compared to other related sectors, Rock Health reported, digital health was a clear leader. Its funding grew 93 percent from 2013 to 2014, while the software sector grew 61 percent and biotech and medical devices grew 14 percent and 3 percent respectively.

Rock Health tracked 295 deals in 2014, while StartUp Health came up with 459. StartUp's biggest deal of the year hasn't changed since the third quarter -- the $400 million infusion physician practice management company Privia Health secured after merging with an entity set up by a group of investors led by Goldman Sachs, a deal Rock Health didn't count as a venture deal at all. Not counting Privia, the two agreed on a top three that included Nant Health's $375 million raise, Proteus's $172 million, and Flatiron Health's $130 million.

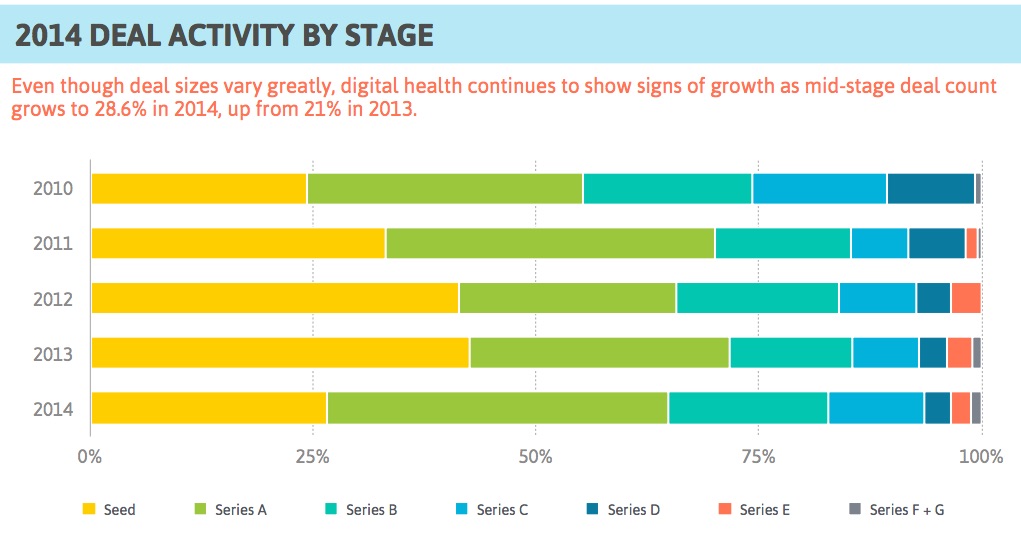

Rock Health observed a big jump in the average deal size from previous years, hitting $14 million after three years of incremental decline between 2011 and 2013. StartUp didn't offer an overall average deal size, but instead listed an average for each of three categories of funding raise -- early, mid, and late stage. Seed and series A rounds averaged $4.6 million in 2014, series B and C rounds averaged 12.3 million, and series D and later averaged 17 million.

StartUp Health's data

StartUp Health's data

Both groups also broke the year's investments into categories to get a sense of what sorts of companies are leading the charge in digital health. Although they differed in how they sorted companies, the same leader emerged at the top of both lists: big data and analytics, which represented $323 million in Rock Health's reckoning and $1.46 billion in StartUp Health's. (StartUp Health assigns companies to multiple categories, which accounts in part for its larger category numbers.) Population health management was the other category that appeared on both lists, at number two for StartUp Health and number six for Rock Health.

After big data, Rock Health listed healthcare consumer engagement, digital medical devices, telemedicine, and personalized medicine as the top categories. StartUp Health listed population health, navigating the care system, diagnostics, consumer health, and practice management. Rock Health also noted the three fastest growing categories: telemedicine, payer administration, and digital therapies (which includes companies like asthma management company Propeller Health and diabetes management company Omada Health).

Both groups had Qualcomm Ventures as the largest corporate investor and Khosla Ventures in the top handful of VC investors for 2014, consistent with other years. Rock Health had KPCB above Khosla, whereas StartUp had Khosla at the top with Founder's Fund in the number two spot. Rock Health also had an interesting observation about the crowdfunding space, which it began tracking last year: the number of campaigns rose in 2014, but the number of successful campaigns and the total amount of money raised through crowdfunding are both actually in decline.

The two groups had vastly different numbers for M&A as well, with Rock Health tracking 95 deals to StartUp Health's 40. Rock Health also totaled up the amount of money spent in disclosed transactions, $20 billion, while StartUp figured out the average funding raised prior to acquisition: $4.2 million.

Finally, the two groups tracked digital health IPOs in 2014. Rock Health concluded that publicly traded digital health companies are so far trading well below the market average, but StartUp's take was a little more optimistic. They said the stocks showed mixed results, with IMS and Everyday Health trading above their IPO pricing and Castlight and Imprivata trading below.