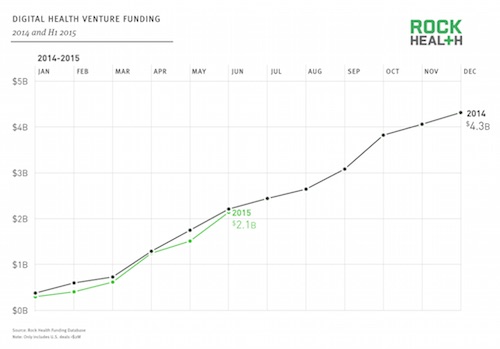

The year so far has seen 136 digital health investment deals over $2 million, for a total of $2.1 billion in funding according to Rock Health's mid-year report. Rock Health tracks a narrower range of digital health companies than others and only tracks deals over $2 million.

That number puts the first half of 2015 just $70 million shy of 2014's first half and more or less on track to match 2014's year-end investment total of $4.3 billion.

"We’re coming off of 2014 which was a really incredible year for digital health funding," Rock Health Managing Director Malay Gandhi, one of the authors of the report, told MobiHealthNews. "So I wouldn’t have been surprised to see the pace come down just because of the law of large numbers and all of that, but we’ve been surprisingly on the same pace as last year, and we know there’ll be quite a few large deals coming in this summer. [For instance, we've already seen] $79 million for 23andMe which ultimately is going to be a $150 million financing once its closed. So I think there’s still a lot of large deals to come."

The average deal size is even up a little bit from last year's mid-year numbers, up above $15 million compared to $14.6 million in 2014. Both the total funding and the average deal size are brought up quite a bit by the two largest investments Rock Health tracked -- Jawbone's $300 million raise from BlackRock and NantHealth's $200 million from Allscripts.

It's worth noting that both these deals are a little more complicated than traditional VC investments, with Allscripts making a reciprocal strategic investment in Nant and BlackRock's money rumored to have some pretty serious strings attached.

That said, the six largest deals, including Jawbone, NantHealth, Virgin Pulse's $92 million round, Health Catalyst's $70 million round and $50 million deals from DoctorOnDemand and PillPack, represented a third of all the funding this year.

Gandhi also said that the company looks at digital health funding as a percentage of all venture funding as a more meaningful metric than funding on its own. So far this year digital health has represented 5 percent of all funding. Last year for the whole year it was between 8 and 9 percent.

"What I generally expect is that digital health will hold between 7.5 and 10 percent of overall venture funding," Gandhi said. "I expect digital health to hold steady. Next year if we cut it in half or we double [overall venture funding], I expect digital health to track as a percentage. ... Everything’s been good this year so far."

The top six categories of deals were wearables and biosensing, with $387 million (though $300 million was Jawbone); analytics and big data with $212 million; healthcare consumer engagement with $176 million; telemedicine with $169 million; enterprise wellness with $128 million; and EHR and clinical workflow with $74 million.

The only shift in deal stage was a slight trend towards more Series B rounds, with Series B representing 22 percent of deals versus 18 percent in 2014. This signals that many of the companies that secured Series A investment last year are continuing to raise funds on schedule, according to the report.

The most active venture investors were HLM Venture partners, NEA, and Venrock with four deals each. On the corporate side, GE Ventures and Cambia topped the list with five and four deals respectively. Although many investments still came from single-deal "dabblers," two new investors had three or more deals: Thrive Capital and RRE Ventures.

Finally, Rock Health tracked a staggering 92 M&A deals, compared to the 95 they tracked in all of 2014, but there's a catch. The deals this year were either more likely to be undisclosed or much smaller: they totaled only $2.6 billion in disclosed values compared to $20.4 billion in 2014.

"With the number of M&A deals being done, there’s a significant number being done within the healthcare industry itself," Gandhi said. "When it’s primarily digital health companies buying other digital health companies and even acquihires, it’s not that interesting. Last year it was $20 billion in transactions, this year it’s under three. So I don’t think deal volume is a good indicator of the overall health of the space. I think who’s buying and how much they’re paying is much more interesting."

He pointed out that last year's acquisitions included interest from major medical device companies like Medtronic. While this year included some small acquisitions by payers and pharma companies, more serious investment from those stakeholders will be a better sign.

Rock Health also tracked five IPOs in the digital health space: Evolent Health, Invitae, Fitbit, Mindbody, and Teladoc, for a total of $1.3 billion in IPO capital raised. An investor survey suggests that likely future IPOs include Jawbone, Practice Fusion, Health Catalyst, or Proteus Digital Health.

In another take on the first half of the year, Mercom Capital tracked just shy of $2 billion in health IT venture funding this half, and $1.2 billion just this quarter. Mercom tracks health IT and digital health as a single category, so it's looking at a different mix of companies. In their report, the most-funded companies were consumer-centric ones, which raised $724 million this quarter in 97 deals, compared with $473 million in 41 deals for healthcare practice-centric companies. Mobile health specifically brought in $214 million in 37 deals for the quarter, and another $282 million via 56 deals in Q1.