It’s hard to characterize what the future of healthcare IT will look like without evoking some form of the word “uncertainty.” With regulatory changes ahead and a fuzzy idea of the economy will look, barriers to innovation are expected. Yet a new survey from VC group Venrock shows many professionals in the industry still expect healthcare IT to grow over the next few years, and even think some sectors of digital health will function with few challenges in the Trump Administration.

It’s hard to characterize what the future of healthcare IT will look like without evoking some form of the word “uncertainty.” With regulatory changes ahead and a fuzzy idea of the economy will look, barriers to innovation are expected. Yet a new survey from VC group Venrock shows many professionals in the industry still expect healthcare IT to grow over the next few years, and even think some sectors of digital health will function with few challenges in the Trump Administration.

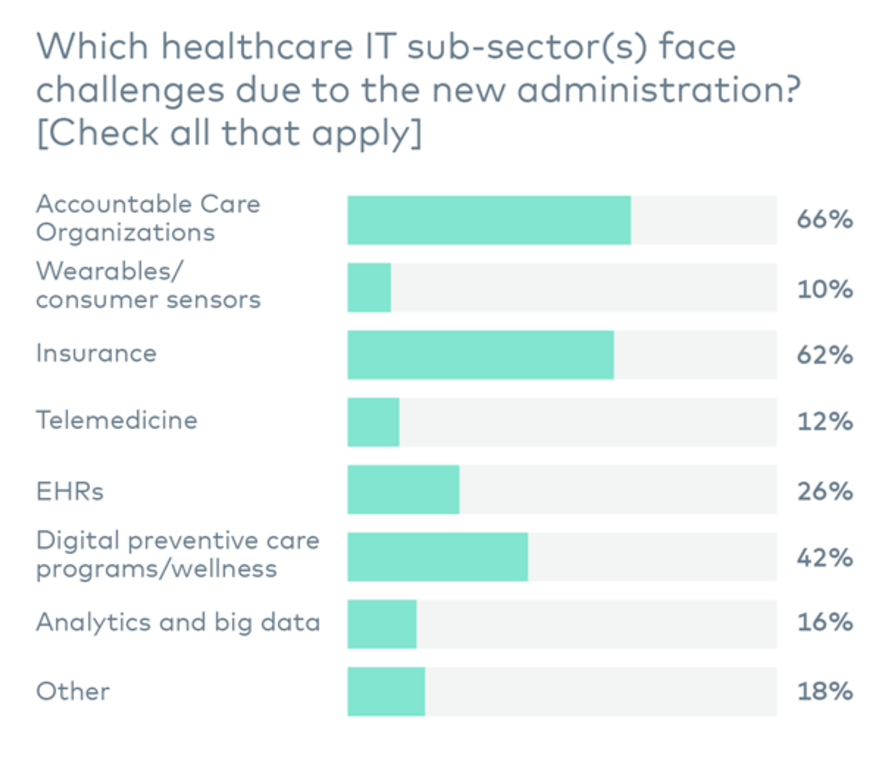

The survey, which was conducted in March prior to the new administration’s failed attempt at a new federal healthcare law, was given to a group of 274 healthcare IT professionals including startups, investors, payers, providers, large employers and those working in government (or, as Venrock referred to the group, “a few hundred of the smartest people we know across healthcare"). Challenges will vary by subsector, the respondents said, and some of the safest will be the newest: wearables and telemedicine.

Only 12 percent of respondents think telemedicine will have a hard time growing under the new administration, and feel similarly about wearable technology. As evidenced, the largest percentage of respondents (42 percent) said they would invest in telemedicine company Doctor on Demand at its current valuation (which is $250 million). Health insurance startup Oscar, by contrast, was last on investor's lists.

Even though some survey respondents may feel confident with investing in certain companies, they don’t expect that to be the norm. Eighty-five percent predict it will be difficult for private healthcare IT companies to raise money at some, if not all, stages of financing.

Almost half said they believed analytics and big data would have the most rapid growth in the next year. While 60 percent of respondents think the number of healthcare IT companies will increase over the next couple of years, they also expect a lot of the existing power to start coming together: 87 percent say the next two years will bring increased consolidation among venture-backed startups in healthcare IT.

The same goes for legacy EMR companies, the respondents said, with 78 percent estimating a surge of mergers and acquisitions among the likes of EPIC and Cerner as they seek out new forms of revenue.

On a policy level, most don’t see the Affordable Care Act really going away: 72 percent think it will be repaired or renamed. From there, most respondents think the biggest challenges lie within Accountable Care Organizations and insurance companies.