During Everyday Health's first quarter earnings call this week, CEO and Co-founder Ben Wolin pointed to strong growth in mobile marketing revenues for the health media company. Everyday posted a $8.1 million loss on total Q1 revenue of $41.2 million, which is up 10 percent over Q1 2014. Mobile revenues grew 35 percent year-over-year, according to the company, and accounted for 38 percent of Everyday's total Q1 revenue. For all of 2014, the company said 37 percent of its revenues came from mobile channels.

During Everyday Health's first quarter earnings call this week, CEO and Co-founder Ben Wolin pointed to strong growth in mobile marketing revenues for the health media company. Everyday posted a $8.1 million loss on total Q1 revenue of $41.2 million, which is up 10 percent over Q1 2014. Mobile revenues grew 35 percent year-over-year, according to the company, and accounted for 38 percent of Everyday's total Q1 revenue. For all of 2014, the company said 37 percent of its revenues came from mobile channels.

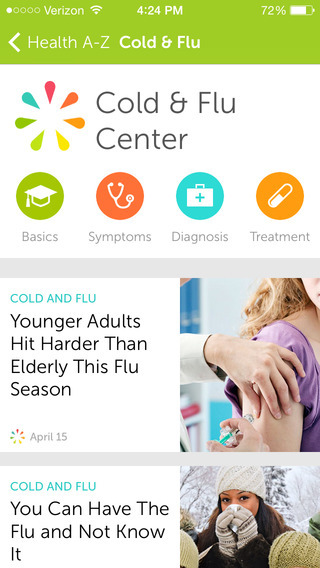

"Like in prior periods, in Q1 we saw strong growth in mobile as a delivery channel for our advertising and sponsorship programs," Wolin said. "Some recent reports have suggested that pharma companies are hesitant to market via mobile channels. That is obviously not what we are seeing or experiencing. It's not something we expect to see going forward... We're highly focused on delivering mobile-friendly content and tools to our users. This mobile engagement also allows us to deliver advertising solutions that monetize equally well across mobile and desktop."

As he also mentioned during the company's Q4 call in March, Wolin said Everyday is aggressively pursuing acquisitions.

"The M&A environment of the digital sector remains very active," Wolin said during the Q1 call this week. "While we are very excited about the progress in our business and the new revenue opportunities I've discussed, we are always exploring additional opportunities to accelerate our growth through acquisitions that are, both smart strategically and financially prudent... We are going to remain active and focused on three pillars that we've outlined in the past. Those really are going deeper with our existing consumers and physicians -- so a website or mobile application or another type of property that would allow us to gain reach our frequency in a specific therapeutic category. Second, new tools or services or companies that service pharma in unique ways that we haven't had in the past. Third, businesses that would be able to take advantage of our existing platform to open it up for existing new customers sets."

Wolin also provided more detail on the company's plans for its newly created payer-provider business unit, which it created late last year. Wolin described the company's thesis by noting that while they traditionally have served pharma's marketing efforts, "our existing audience, content and data assets are well suited to address the critical needs of payers and providers, which all need to more directly engage with consumers now, whether for direct recruitment, care management or medical cost reduction."

Wolin also provided more detail on the company's plans for its newly created payer-provider business unit, which it created late last year. Wolin described the company's thesis by noting that while they traditionally have served pharma's marketing efforts, "our existing audience, content and data assets are well suited to address the critical needs of payers and providers, which all need to more directly engage with consumers now, whether for direct recruitment, care management or medical cost reduction."

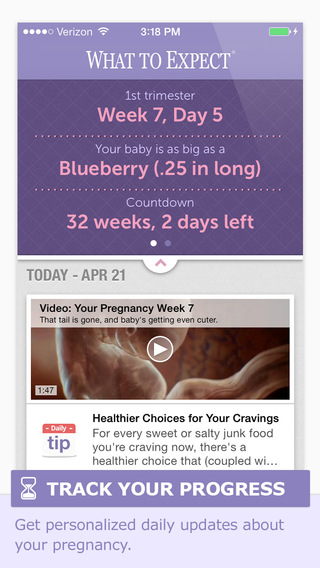

Everyday is starting to work with payers on its popular What To Expect pregnancy website and apps. Wolin said What To Expect brought in more than 2 million online registrations last year, which might account for half of all pregnancies in the US last year since there were about 4 million total births.

"Due to the power of the brand, these women voluntarily share a tremendous amount of information to customize their pregnancy experience," he said. "And a significant percentage of these women register before their tenth week of pregnancy. This means that we typically know that these women are pregnant before their doctor does and long before an insurance company processes the first pregnancy claims, by which point it could be too late to take action to address pregnancy-related complications or implement effective prenatal care. Health complications during pregnancy, costs payers more than $26 billion annually. We are partnering with insurance companies to improve communication focused on prenatal care in order to improve outcomes and ultimately reduce costs."

Wolin said that payers can drive some behavior changes among their existing members by working with What To Expect since so many pregnant women register with the website each year.

Given this is the company's first major payer initiative and Wolin's bullish comments about future acquisitions, it would not be surprising if Everyday Health is evaluating whether it should acquire any of the growing number of startups focused on fertility, pregnancy, and women's health.