Caring for a sick or elderly family member presents many challenges, and financial strains is high up on the list. On average, family caregivers spend 20 percent of their income per year in out-of-pocket expenses, according to a new survey by AARP.

Caring for a sick or elderly family member presents many challenges, and financial strains is high up on the list. On average, family caregivers spend 20 percent of their income per year in out-of-pocket expenses, according to a new survey by AARP.

In a survey of 1,864 caregivers (using GfK’s national, probability-based online survey) AARP found more than 75 percent are racking up out-of-pocket expenses to the tune of $6,954 per year.

While the market for senior and caregiver services is growing, with more digital tools and support rising up to meet the need, not everyone directly involved in caregiving is necessarily aware of, engaged with or can afford such support services. For example, only about 8 percent of respondents reported spending money on remote health or safety-monitoring devices, and only 10 percent spent money on assistive technologies or devices.

The bulk of long term care services are provided by unpaid family caregivers, and AARP has found that there are approximately 40 million family caregivers currently providing care to an adult care recipient. In addition to the financial strain, caregiving is a complex, time-consuming and emotionally challenging task that most do not receive training for, the association wrote.

“Family caregivers often take on a wide range of activities from managing finances, transportation and housework to medication management, bathing/dressing, and feeding,” the survey states. “Family caregivers not only spend time and energy caring for an adult relative or close friend with care needs, but many also spend money of their own to help care for the care recipient.”

On top of the caregivers’ out-of-pocket costs, many are also experiencing strain on their work and personal life, the survey found, with more than half reporting having to take time off work, change their schedule, cut back on personal spending, cut back on personal time, or dip into their retirement savings.

For certain demographics, the financial strain is even higher: Latino caregivers, for example, spend an average of $9,022 per year, or 44 percent of their income, those who care for someone with dementia ($10,697), and long-distance caregivers (those living an hour or more away from the person for whom they are caring) incur costs of nearly $12,000 per year. Female caregivers alone also spend more time and money on caregiving than their male counterparts.

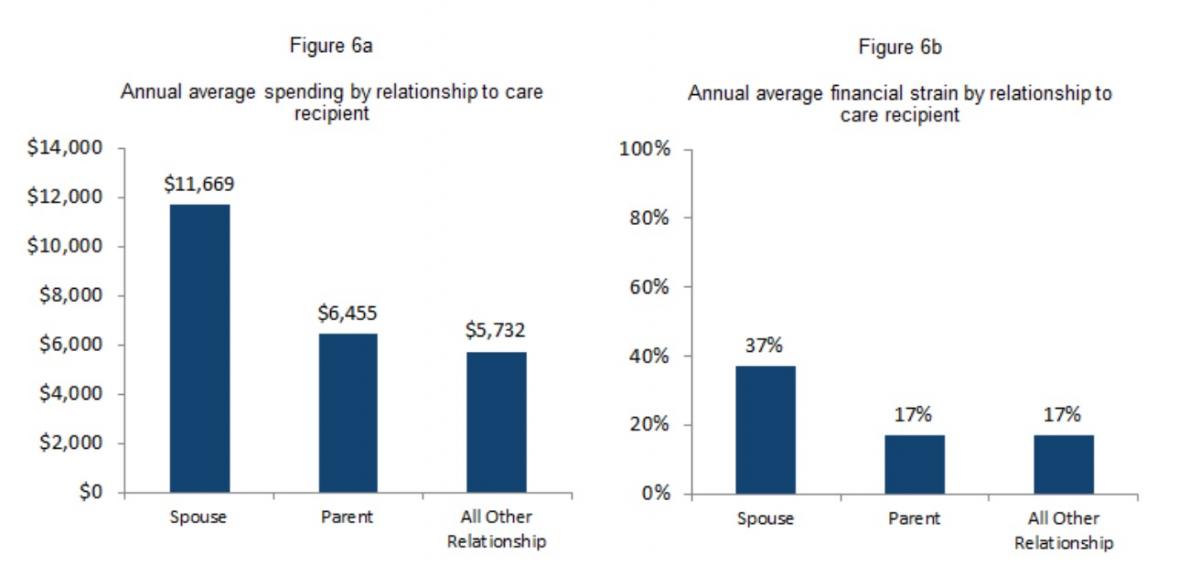

It also depends on who they are caring for: caring for someone over the age of 50 translates to higher costs, as does caring for a spouse versus a parent or child. Those who care for someone who needs assistance with at least one daily activity of daily living fall into the category of the most highly financially strained, and caring for a spouse often means being less likely than other caregivers to pay for help.

The biggest portion of that spending is that for household expenditures, such as rent or mortgage payments or home modifications, which accounts for 41 percent of caregivers’ spending. Medical expenses come second, at a quarter of caregiver expenditures, followed by legal and travel expenses, then extra help such as adult day care services or other paid help.

“This finding raises the importance for not only education and assistance for family caregivers but also financial assistance such as a family caregiver tax credit that would help address the financial challenges of caregiving,” the survey authors wrote.