Seventy percent of health insurance companies have published only one or two apps and 67 percent of those companies have achieved less than 100,000 downloads on the apps they do have, according to a new report from Research2Guidance. The report analyzed app offerings from 79 health insurance companies from around the world.

The report follows on the heels of a similar look at the pharmaceutical industry, which found that pharmaceutical companies have a lot of apps in the market, and have been making apps for a long time, but their apps aren’t seeing downloads and usage on par with the apps from other industries.

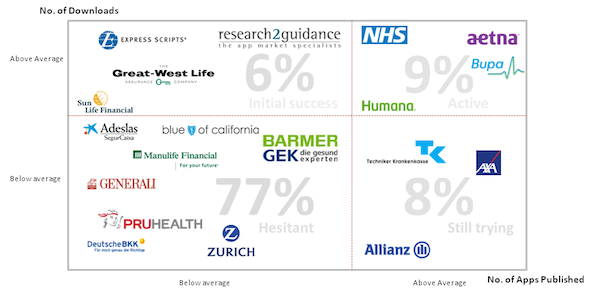

As they did with pharma, the analyst firm broke app publishing payors down into four quadrants: those with above average downloads and above average numbers of apps ("active"), those with above average downloads but below average number of apps ("initial success"), those with below average downloads but an above average number of apps ("still trying") and those below average in both categories ("hesitant").

Seventy-seven percent of companies were in the hesitant category, including Blue Shield of California and a number of payors outside the US. Just 9 percent were in the active category, which included both Aetna and Humana.

"Aetna is the one health insurance company that stands out," Research2Guidance analyst Samuel Aylett wrote in a blog post. "Having published 28 apps across both iOS and Android, Aetna have achieved more than 14 million downloads, significantly more than any other health insurance company. That being said, 85 percent of those downloads come from just one app within their app portfolio, iTriage. This is not uncommon amongst those health insurance companies that have generated a large number of downloads. For example, 7 of the top 10 biggest health insurance companies' app portfolios generate more than 50 percent of downloads from the top performing app."

It's worth noting that iTriage was originally created by a startup, called Healthagen, which was acquired by Aetna, not built in-house. Research2Guidance presents some theories as to why payers fall behind in building apps that gain traction.

One, Aylett writes, the apps don't incorporate what the firm considers the six elements of best practice: "tracking and coaching, automated input, remote consultation, secure use of mHealth data, integrating their solutions into the current IT healthcare infrastructure and beautiful design and usability." He also posits that not enough insurers use apps to link healthy behavior to financial rewards, and most payors miss opportunities to cross-promote their apps to drive adoption.

"Best practice mHealth app publishers manage to have almost equally successful apps in their portfolio by cross promotion, using, for example, 'more apps' screens, pop-ups and push notifications," Aylett writes. "This is not being done at all by health insurance companies."